Weekend Wall Street #1: Stocks Picks and News To Watch Next Week

By reading this you agree to the disclaimer at https://aditdayal.wixsite.com/disclaimer.

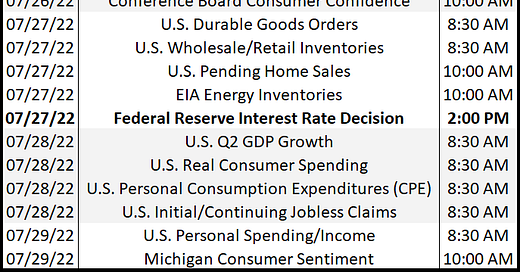

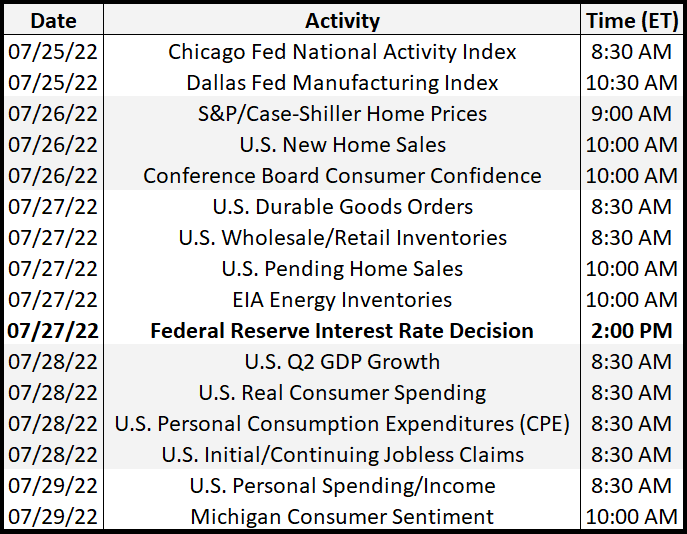

Economic Calendar (important for next week):

The most important is the 7/27/22 Interest Rate decision here because we should see a huge reaction to the market there. I’m expecting a 75 or 100bps rate hike, especially as inflation hits an all time high I really think the fed is going to start doing something here to tighten.

Another thing is that the cost of everything has increased dramatically, so it’s important to note that it’s very possible the Fed takes steps to do a 100bps hike. This will not be good for the market IMO.

This week is full of binary events. We have the Fed’s rate decision number coming out on Wednesday, but more importantly to me we have the earnings of most of the big players in the S&P. Last quarters GDP earnings will most likely be the biggest mover this week.

Here are the earnings below:

If you are trading options, you need to watch for IV crush or you will lose on both calls and puts. These are the implied moves you need to profit:

AAPL 0.00%↑ Implied move 5%

AMZN 0.00%↑ Implied move 7.2%

META 0.00%↑ Implied move 11.8%

GOOGL 0.00%↑ Implied move 7.1%

MSFT 0.00%↑ Implied move 5.1%

BA 0.00%↑ Implied move 6.3%

QCOM 0.00%↑ Implied move 7.8%

INTC 0.00%↑ Implied move 8%

I will release my earnings trade ideas tomorrow.

Let’s take a look at some trade ideas for this week:

1. Long ALDX 0.00%↑ . Nice bull flag on the chart here and huge volume this week. I also like the bullish wick on Friday here. Can be a nice trade and I would sell before earnings.

PT: 7 SL: 4.50

2. Long SBIG 0.00%↑ . You can check out my full DD in my previous post, but the chart is amazing. The fundamentals and the theme of this play fit right into what De- SPACS are doing right now and this one is cheap with great R/R

3. Short COIN 0.00%↑ . I truly think this stock has only gone up in the recent days because of shorts exiting their positions before earnings, and I think post ER their stock should go to all time lows. But to trade before that, I think that the best way to play it is to go short here. Options flow is bearish as well.

PT: 30 SL 90

4. Long FAZE 0.00%↑ . This is most likely going to be the short squeeze play of the week. I’m in some shares at $12.38, but I think this can see 20’s on the short interest numbers. Roughly 1.5mil share float with 125% short interest and 300% cost to borrow should create fireworks tomorrow.

PT: 22 SL: 10

5. Short JWN 0.00%↑ Nordstrom. Impressive strength, but in this market so far that strength has not been rewarded. As long as we stay under resistance at 25 this can make for a great short back down to 20. Huge put buyers on the tape as well last week.

PT: 21 SL: 25

6. Long BBAI 0.00%↑. Huge downside day on Friday, but it’s possible that shorts need to cover before earnings coming up. The cost to borrow is insane at 400%, so it’s very possible that shares are running out and will cause a panic buying day soon.

PT: 5 SL: 2.20

7. Short SNOW 0.00%↑ . Huge rejection from supply zone here. Under 140, this can go back to the 120’s. MACD crossing down and RSI is not oversold yet like many other tickers. Watching for a play under to to make a move back. Large puts being bought on the tape as well.

PT: 122 SL: 162

That’s it for this week’s weekend Wall Street! Thanks for reading!