Weekend Wall Street #64 - Welcome to The Great Depression

By continuing to read, you agree to the disclaimer at www.aditdayal.wix.com/disclaimer

Welcome to The Great Depression says Cathie Wood and… let me check….nobody else.

Happy weekend everyone and welcome back to Weekend Wall Street The markets continued higher by a slight 0.3% last week, with some sellers finally showing themselves. The short week should have a lot of opportunities for us…

Let’s take a look at what next week has in store for us!

This week, a new effect will go into place which might have a MASSIVE impact on small accounts. A lot of people who trade accounts under $25K don’t use a margin account because of the pattern day trading rule (can only make 3 day trades in a 5 day rolling period). This rule can be counteracted by using a cash account, but the cash must settle before one can use more, for example, if I have $500 in my account I can only trade $500 worth and then the money has to settle again. For options, this money settles overnight, known as a T+1 settlement. But for equity, it takes T+2 for trades to settle, which means a lot of investor capital is not available to trade shares with. That is no longer after May 28, with equity, ETF’s, corporate bonds, and more instruments finally moving to a T+1 schedule. This is good because a shortened settlement time can reduce failure to delivers, or the chance of a security not being there when the trade needs to be settled. The shorter settlement cycles should make it harder for abusive short selling and manipulation in availability of shares to take place in the market as trades will be recorded and accounted for much more quickly. It should also make it much easier for retail traders to invest in what they actually want to, when they want to.

Cathie Wood from Ark Investments is back with another wild take that’s gaining traction in the markets. She compared the market to the Great Depression (??) and said investors are in a desperate search for safety, right after the markets hit new all time highs. She’s worried that the concentration of large caps is the highest it’s been (referenced is the Goldman Sachs’s chart below) and that the crowding in large caps is just investors really looking for something safe. Therefore we should see a reversion to the mean and money spreading out into different names as the market stabilizes again, from her point of view.

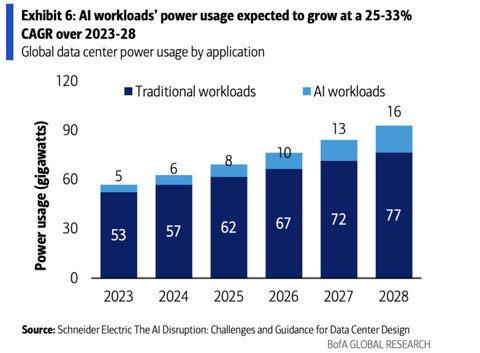

Microsoft has been making headlines for their new AI computers which claim to be some of the best in the industry with some wild features. Morgan Stanley thinks AI computers will be 68% of the PC market by 2028 and Apple has recently reported a slowdown in sales of their Macs. I think Apple is in a very interesting spot and can completely refresh their lineups to match this growing AI-PC market, but they have to act swiftly or names like MSFT will easily eat them up with these increased computing powered machines. AI is still extremely strong, with NVDA posting huge gains of earnings, letting the market look for other AI winners. I think we're going to start to see a shift into how we're actually powering these AI names - with Bank of America highlighting $VRT as a good play for cooling of data systems. Another name I know that does this is $MOD, and I think both are going to be good plays post earnings if usage of AI is truly growing.

The meme rally might also actually be back for GameStop. Last week I reported that all the meme names were capitalizing on the crazy moves in order to raise capital to reduce their debt load, or invest in new projects and GameStop has completed their offering raising over $900mm. This can be interesting because it allows them to take some time to revamp their business, and if they can turn around, we know that retail absolutely LOVES this name.

#1) Earnings week is much slower, but some Twitter-loved names like CAVA and CGC are reporting. DELL had a huge run so expectations are much higher than last earnings and BIRK is a name I think has a good chance of beating with the Summer months coming up and recent IPO.

#2) On Monday, the market is closed due to Memorial Day.

#3) On Tuesday, the Chevron acquisition of Hess will be getting their vote from shareholders. Some shareholders have sent out letters to vote against the acquisition, which should work out to $171/sh while the stock trades at $150.

#4) On Wednesday, US video game reports will be released, Bill Ackman’s Pershing Sq. will host an investors call, and the Fed’s beige book report will be released at 2 PM.

#5) On Friday, the core PCE report will be released giving more insights into how inflation is going in the country.

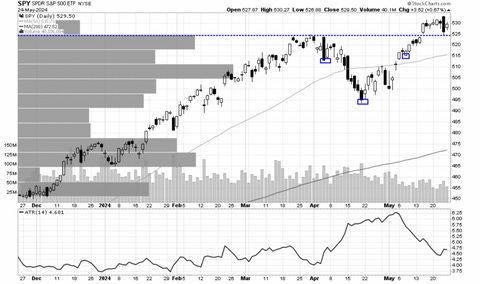

S&P 500

The S&P 500 ($SPX index) has broken out once again to new highs in a very bullish inverse had and shoulders pattern. Testing and holding as volatility contracts (good sign, shows digestion of price). Inside bar printed on Friday and is still holding after what was a really strong red day on the day after NVDA earnings. A failed breakout is usually a fast breakdown, so I’m watching closely for any cracks this week.

My key breaks are $533.02 for bulls and $524.64 for bears.

The best ways to play the S&P 500 are via. SPY/SPX options or SPXL (3X Bull S&P 500 ETF.

INDIVIDUAL STOCKS & LEVELS

Let’s recap some of the levels of some popular names:

TSLA

Tesla is consolidating here and actually holding more strong than I expected it to with the negative sentiment around it. It’s in a pretty choppy place, but over $185 would signal that we’re bottoming here since it’s rejected so many times. Their robo-taxi event is garnering attention, but there’s a lot of uncertainty around the elections and EV’s, Elon, and more, and the market hates uncertainty.

AAPL

Apple is still holding at the highs off the good news of a $110B buyback (largest ever, for any company) and they have their AI event coming up this June in just a few weeks. I think this is a good spot for consolidation for the name since earnings weren’t super impressive to me other than the buyback. I still have a PT of $210 for AAPL before a larger retracement.

RIVN

Rivian is trading really nicely here at the lows, holding and consolidating and I think this can see a bounce soon from here to $12.50. Riskier because it’s an EV play but with nearly $8 in cash/sh this isn’t a bad spot for a bounce.

Insider Activity

One of my favorite names, HIMS, got a massive ~$2M buy and ALLO is another cheap name with a huge purchase.

Thanks for reading this weekend’s article, have a great week!

-Adit Dayal (www.twitter.com/realaditdayal)