Weekend Wall Street #57 - Make the Market Stop!

By continuing to read, you agree to read the disclaimer at www.aditdayal.wix.com/disclaimer.

Happy weekend everyone and welcome back to Weekend Wall Street. The market continues to break expectations and roar to new highs around an amazing earnings season and news from the Fed. Consumer sentiment continues to increase, and news from the likes of META and AAPL shocked traders last week and provided some huge opportunities.

Let’s take a look at what next week has in store for us!

The Federal Reserve made their decision on interest rates this Wednesday deciding to keep it steady, but also indicating they’re looking to do three rate cuts at some point this year as well. The Fed Funds rate is the rate for banks to lend overnight, but other variable forms of borrowing for the consumer are essentially directly tied to the Fed Funds rate. Mortgage rates are what real estate investors have a close eye on when rates start to come down, with the chief economist at Fannie Mae expecting mortgage rates to come down to 6% by the end of the year.

Amazon reported stellar earnings this week and overtook Google for the first time in regards to market cap. Sales and revenue both beat Wall Street estimates, but the real money for Amazon is in their web services. The company stated large new interest in their AI offerings and cloud spending is finally picking up. They also stated enthusiasm from companies in regards to advertising, providing optimistic guidance for the future of the company. That being said, Jeff Bezos is exiting a significant stake of his Amazon holdings (~50mm shares) next year as reported by one of his filings. I don’t think this is a big deal, as it’s pre planned so I wouldn’t use that as any sort of bear case for the stock.

The drama between JetBlue, Spirit Airlines, and their planned merger is still far from over with the appeal now in place. The schedule is so that all arguments are in by Feb 26 and the court will hear the case in June, which is important because the deal expires in July. Spirit Airlines is reporting earnings this week and new information from them can provide some inefficiency to take advantage of.

Real Estate stocks are struggling due to prolonged interest rates with many real estate names missing on their earnings. Regional bank stocks also had a pretty terrible week after New York Community Bancorp put fear into that sector. The stock tanked after reporting $552mm in credit losses vs. an expected $44mm. Scarce transactions in the commercial real estate market have affected their valuation with no real catalyst for a better outlook moving forward. The debt NYCB has may be downgraded by Moody’s setting a pretty grim outlook for this company and CRE’s in general.

#1) Earnings week is coming in strong after a huge week from big tech. A lot of interesting names which can give guidance on AI (like Chegg and Spotify) with more consumer names coming in as well to report on how the average person is spending.

#2) With the Super Bowl on Sunday, we may see a move in stocks related to football or sports betting. I also expect companies with big advertisements to garner attention online and see additional volume.

#3) On Monday, Fed President Bostic will speak at 2PM, and on Tuesday Cleveland Fed President Mister will speak at 12PM.

#4) On Wednesday, the Mannheim Used Car report will be published, and auto stocks may move off of this news.

#5) On Thursday, Spirit Airlines will give their earnings results after the stock has traded with extreme volatility after the failed JetBlue takeover.

S&P 500

The S&P 500 ($SPX index) continues to trade up in this channel.

My key breaks are $498.37 for bulls and $488.20 for bears.

The best ways to play the S&P 500 are via. SPY/SPX options or SPXL (3X Bull S&P 500 ETF.

INDIVIDUAL STOCKS & LEVELS

Let’s recap some of the levels of some popular names:

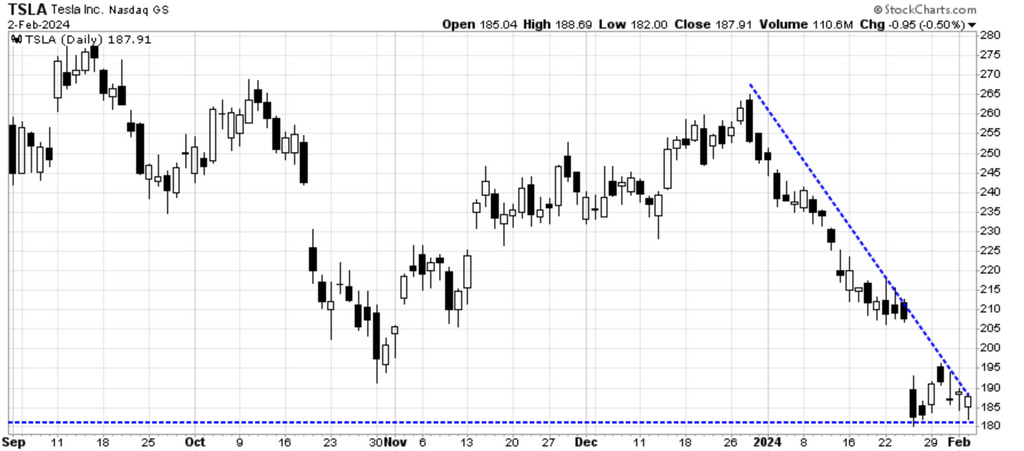

TSLA

It feels like Tesla is the only stock that hasn’t joined the market on this massive rally to new all time highs after what the market considered a very-subpar earnings report. There is a gap to fill above, but with this much relative weakness, I think it’s still in a position to stay short.

AAPL

Apple did a fakeout move post earnings at the $180 level last Friday. The company reported results, beating market estimates, but missing expectations on China revenue. This weekend had a lot of media coverage on the new Vision Pro headset, but the main and unusual thing was Apple teasing their work on generative AI for later in the year. Tim Cook states they don’t usually preview work, so it was interesting to see them do. I believe we will hear more about this at the WWDC conference in June.

UAL

Airline stocks are all consolidating, trailing the market a bit, but in my opinion I think they’re in an accumulation phase. I think this month we may see a breakout in stocks like United, especially as we some rotation from big tech names.

FLWS

This is a great name in a bull flag before Valentines Day hits in two weeks. There may be a trade to front run the holiday early at the start of this week with a stop loss at $9.75.

Insider Activity

Insider buys were plentiful this week (good sign for market sentiment), and it was interesting to see RMCF (Rocky Mountain Chocolate Factory) get some hits from insiders before Valentines Day.

Thanks for reading this weekend’s article, have a great week!

-Adit Dayal (https://twitter.com/tradelikehulk)