Weekend Wall Street #56 - All Time Highs

By continuing tor read, you agree to the disclaimer at www.aditdayal.wix.com/disclaimer.

Happy weekend everyone WEEKEND WALL STREET IS BACK! FOR FREE!

What a start to 2024 with the overall market hitting new all time highs, AI making huge leaps forward, and massive moves in different commodities. There’s space for so many opportunities this year and they’re all playing out very smoothly.

Let’s take a look at what next week has in store for us!

The market hit new all time highs with massive moves in the technology sector, helping push the S&P to hit a high of 4,842. As we usually do, when something out of the ordinary happens in the market (like a new ATH after 512 days, first time since 2013), my favorite thing to do is look at historical data and see if there’s a trend that can guide what happens next.

The one week lookahead isn’t great and could signal that we are in for a slight pullback next week, but over the next month there’s an 71% signal that we’re going to end higher. What this tells me is that next week we’ll may likely see a bit of sectional rotation away from the top performers that drove this really (tech stocks may consolidate) and into some other sectors that lagged behind pushing this rally higher. The great news is that over the next 252 trading days (aka 1 year) there’s a significant 92% chance the market will be higher. It’s times like this where historical data backs a breakout and matches with Goldman Sachs price target of 5100 for the market this year.

Crypto-junkies have been going insane over the last month with so many different narratives about spot traded Bitcoin ETF’s (the SEC’s Twitter actually got hacked before the approval), but this week we finally had the first full week of trading. Aniket Ullal of CFRA Research said in an interview with MarketWatch explains that there is current excitement around the spot ETF’s, but there should be a longer grind up over time. Grayscale’s ETF charges the highest management fee over the other 10 that were approved, and they’re pretty much identical, so I think the best one for retail investors is the IBIT (Blackrock) Bitcoin ETF.

Under the radar, McDonald’s has been testing a new type of store called CosMc’s, which is a competitor to Starbucks (SBUX) and Dutch Bro’s (BROS) trying to capture the every growing drink market, with the McDonald’s CEO describing it as a new $100B market he wants to capture with massive margins.

Data from an independent research firm is showing that there are 2X more visits per month at this test location and over 3X the traffic per square foot. McDonald’s will likely test this in areas with a younger population and if successful (keep an eye out for headlines of new stores opening, anything more than 10 this year is an indication that these stores are doing better than analyst expectations) and could be a huge and unexpected new competitor to Starbucks and Dutch Bros.

Depending on where you’re reading this from, there’s a high likelihood you were really cold this week after a massive front came into the US. Most would think that the price of the commodity natural gas would skyrocket due to these conditions, but prices are forward looking and natural gas has hit a new year low. The reason for this, via Bloomberg, is that there is 1) a lot in storage and 2) the forward looking weather for winter is actually pretty warm. The spring temperatures are looking warm and I think traders are pricing that in now. Based on seasonality, prices could bottom in late February into the end of the year.

#1) Earnings week is coming into play here with some really fun names including some airlines (high volatility post the Sprit Airlines merger drama this week), Netflix, and Tesla.

#2) On Monday, the blackout period from the Fed begins, although there will be interest rate decisions from different foreign banks this week.

#3) On Wednesday, Tesla will hold its earnings call and my favorite catalyst of the month, the Nasdaq will release the official short interest numbers for the month and we can look for some fun squeeze trades.

#4) On Thursday, the European Bank will release their statement on monetary policy.

#5) On Friday, the PCE price index will be released with an expected 2.9% YoY increase.

S&P 500

The S&P 500 ($SPX index) broke out after this period of consolidation into new highs. My price target for this week is the 1.618 Fibonacci resistance at $484. A break under $474 signifies a larger timeframe false breakout.

My key breaks are $484 for bulls and $476 for bears.

The best ways to play the S&P 500 are via. SPY/SPX options or SPXL (3X Bull S&P 500 ETF.

INDIVIDUAL STOCKS & LEVELS

Let’s recap some of the levels of some popular names:

TSLA

I really liked Tesla at this confluence level before earnings where I imagined shorts would cover before the report next week. Longer term, of course earnings are important, but this is the name that leads the EV space as a whole. One catalyst we should be preparing for is the election this year where each party will give their thoughts on new EV policy that can make this great swing trades later in the summer.

AAPL

Apple has been respecting technicals really well before the release of their Vision Pro headset next month. After a double bottom this is approaching the resistance from the earnings gap and I think if we stay under this level, this name can drag down the rotation from tech as it consolidates (as I mentioned a few paragraphs above). A close above $192 and we can head to the GS price target of $210 over the next three months.

EDR

One name in a great bull flag that’s ready to break out is EDR. Silver Lake Mngmt is selling off parts to EDR as it goes private and that could prove to be a positive catalyst for the name to help push a bigger move.

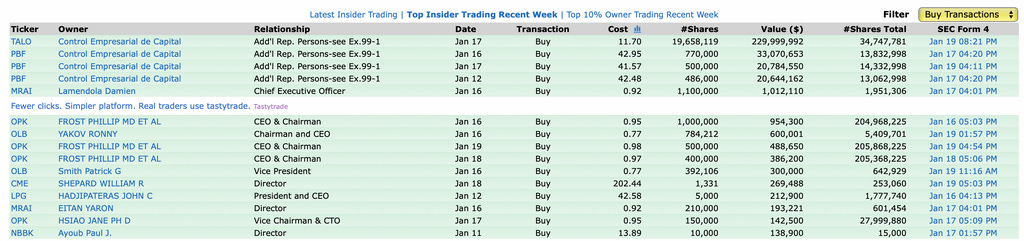

Insider Activity

Insider buys were pretty slow this week, but the most interesting one is NBBK with a great chart and a recent IPO.

Thanks for reading this weekend’s article, have a great week!

Please share this with you friends to help me keep taking a few hours out of my weekends to do research and write these for free.