Weekend Wall Street #5 - The Best Trades for 8/29-9/2

By continuing to read, you agree to the disclaimer at www.aditdayal.wix.com/disclaimer.

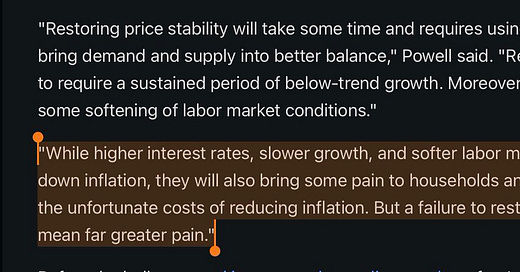

What a week we have upcoming for us! With a huge drop in the markets last week, I’m expecting more downside after the Fed’s Powell’s Hawkish statements:

To be honest, I didn’t think that Powell would say there’d be “pain to households and businesses“, but that just proves to me the Fed might be serious this time- only time can tell though. Until then, we’ll just play price action!

Let’s take a look at some of the catalysts for Monday:

As you can tell, there’s a lot of catalysts for individual companies here, and some of your favorites may be impacted, maybe by NASA’s space launch.

Next up, I want to take a look at SPY 0.00%↑ S&P 500, since this is obviously one of the hottest charts in the market right now.

The weekly chart is a pretty telling story here as we break down from this rising wedge. The key line in the sand is 397 on SPY 0.00%↑ or we will most likely see a lot more downside into one of the most bearish months in the year in September.

There are many ways to play this downside:

Put options on SPY 0.00%↑ or $SPX

SPXS 0.00%↑ which is a 3X inverse ETF of the S&P 500

Put options on individual holdings (aka AAPL 0.00%↑, TSLA 0.00%↑ , etc)

Sell calls on stocks which you own 100 shares of in order to hedge the portfolio as your shares go down.

Sit on your hands aka cash and small daytrades only.

But one thing that has always intrigued me is the ability for small caps to ignore overall market sentiment when there’s a catalyst behind it. Let’s take a look at some setups:

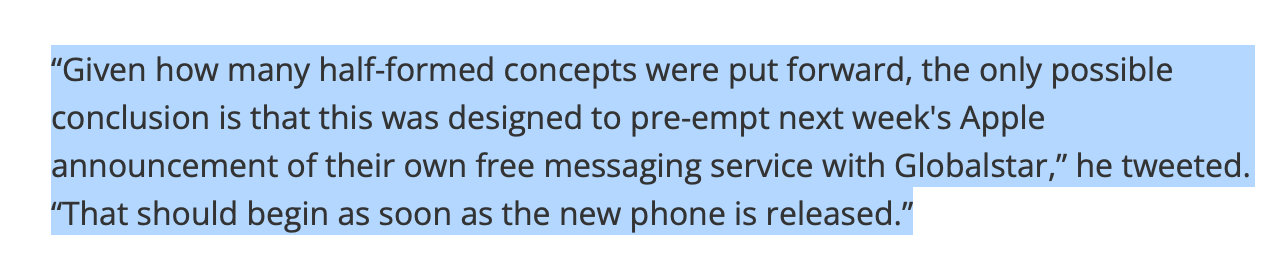

1. Long GSAT 0.00%↑ . This is one stock that's going to be extremely catalyst driven over the next few weeks but absolutely loves to moev. Breaking over resistance this can see new highs. One thing is that this stock can be impacted by NASA's launch on Monday, but I dont think that is the true catalyst. A Satellite analyst predicts that AAPL 0.00%↑ Apple will use GSAT 0.00%↑ technology to include satellite connectivity on the new iPhone 14. If this is true, this will be huge for the stock. The reason i'm including it on the watchlist is because I think there was a leak and insiders bought some call options on GSAT 0.00%↑ for post event expiry. I will take a few lottos on these tomorrow. PT 3 SL 1.75.

2. Long DRV 0.00%↑ . I was looking through some charts and I realized that in the midst of all the madness, real estate stocks were still lingering pretty high. To short the real estate stocks the best pick I found was DRV 0.00%↑, the 3X Bear Real Estate ETF. This should provide pretty good risk reward here, and with puts hitting on XHB 0.00%↑ , the bullish real estate ETF, I think this can be another winner. PT 75 SL 32.

3. Short BITO 0.00%↑ . This is the Bitcoin ETF and one thing to note is that when things get rough, people tend to move their money out of the highest risk classes- crypto and biotech stocks. Huge put buyers in BITO 0.00%↑ as well proving to me that we may have more downside. PT 7 SL 14

4. Short RVLV 0.00%↑ . This chart is great with the stock retesting its breakdown point here, and with the market weak, if it fails it's most likely going to have another leg down. It got puts hitting the tape as well so it may be a name to watch to short in the upcoming days. PT 19 SL 25.

5. Long WEBR 0.00%↑ . This name has been holding lots of key levels and getting a sold amount of volume here these past few days. Though some other websites show other stocks with a higher short interest amount, this is the only stock that has the same numbers on Shortsight, Ortex, and Bloomberg, so it's the main short squeeze pick for me this week. PT 12 SL 7.75.

This is my personal short squeeze watchlist for the week aka the stocks with the highest short interest in the market:

Here is the Fintel Squeeze list as of this weekend:

#1 () FAZE —— SI: 84.25 | CTB: 678.14 | SA: 0.00 | DTC: 1.89 | MC: 1,228.27

#2 (20 ↑) PETZ —— SI: 27.19 | CTB: 61.70 | SA: 15.00 | DTC: 0.91 | MC: 18.88

#3 (2 ↓) MICS —— SI: 23.94 | CTB: 105.65 | SA: 15.00 | DTC: 1.72 | MC: 27.70

#4 (2 ↑) APRN —— SI: 35.97 | CTB: 25.80 | SA: 9.00 | DTC: 0.33 | MC: 199.38

#5 (2 ↑) WEBR —— SI: 52.12 | CTB: 38.47 | SA: 7.00 | DTC: 2.45 | MC: 495.18

#6 (24 ↑) CMPO —— SI: 37.30 | CTB: 7.11 | SA: 30.00 | DTC: 8.85 | MC: 89.65

#7 (2 ↓) GLSI —— SI: 20.75 | CTB: 11.34 | SA: 100.00 | DTC: 4.88 | MC: 117.85

#8 (3 ↑) AVTE —— SI: 32.77 | CTB: 7.35 | SA: 10.00 | DTC: 22.11 | MC: 503.63

#9 (1 ↑) INDO —— SI: 10.55 | CTB: 152.45 | SA: 0.00 | DTC: 0.03 | MC: 89.45

#10 (8 ↓) REV —— SI: 20.52 | CTB: 91.26 | SA: 0.00 | DTC: 0.27 | MC: 351.75

Lots of great setups this week but the main thing I like to tell people is that no matter the setup it’s the execution that will determine the trade, so make sure to follow your stop losses, especially since we are in a bear market!

I hope you enjoyed reading, once again for access to articles like this every week along with exclusive posts, consider becoming a paid subscriber and supporting the writing.

-Adit Dayal.