Weekend Wall Street #37 - Surprise OPEC Cuts, Futures Plans, and Best Trades for 4/2-4/6

By continuing to read, you agree to the disclaimer at www.aditdayal.wix.com/disclaimer.

Happy Sunday everyone and welcome back to Weekend Wall Street. Last week the market got a huge bullish breakout with the Nasdaq seeing the best quarter since 2020.

A lot of analysts, looking back on previous data, are seeing that we may be in for a good year. If Q1 of the year has a gain of +7% in the S&P 500, the year has ended up green 16/16 times- closing at an average of +23%!

This has even led Big Short Burry to claim a switch in sentiment:

Last week and this weekend, we got some big moves and news in three sectors- EV stocks, Oil, and AI names.

This weekend, Tesla released their delivery numbers which just edged past estimates of 421.2K with a released number of 422,875. It will be interesting to see how investors react to this news because of the amount of price cuts in the EV industry. The smaller names are also releasing their numbers, including NIO which reported a 4% YoY growth in deliveries.

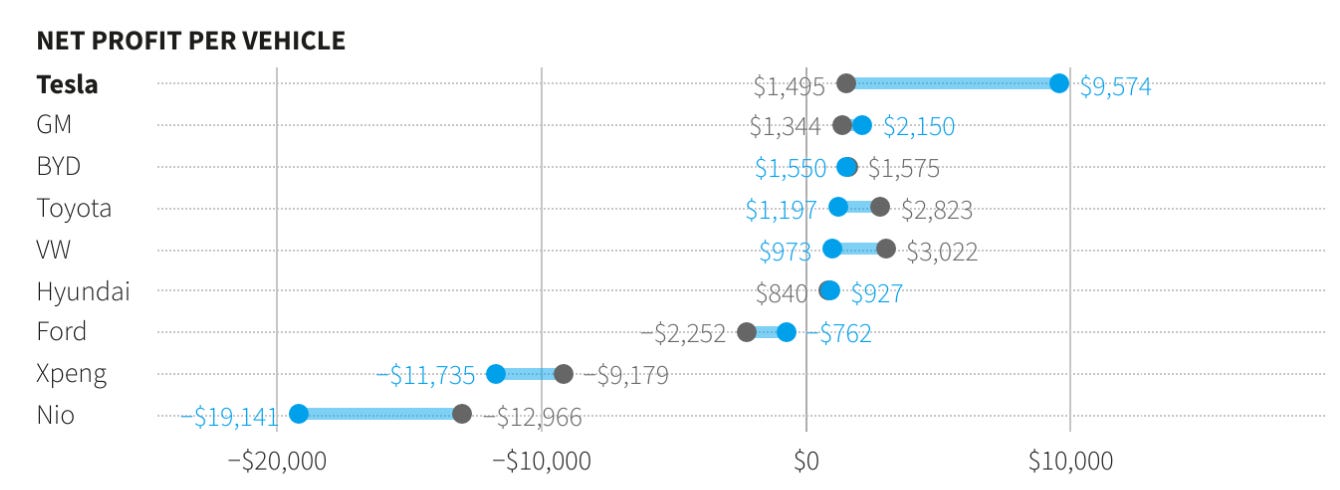

I do not think that price cuts are bad for these companies- in fact, specifically for Tesla, they profit more money than any of their rivals per car sold. Essentially, I don’t think these price cuts are a bearish sign because they are using their production cost advantage to fund them.

This strategy of using this advantage to bully out smaller competitors is not new and has been used by Ford and Toyota in the past.