Weekend Wall Street #36 - S&P 500 Plans, Popular Stocks, and Fed's Inflation Number for 3/27-3/32

By continuing to read, you agree to the disclaimer at www.aditdayal.wix.com/disclaimer.

Happy Sunday everyone and welcome back to my Substack newsletter. Last week was choppy, although a great week to trade because of the range we got every day with the 200DMA acting as a crucial line of support for bulls, and the 50DMA acting as resistance for bears. I am confident the market will make a large move this week and I will explain why in this newsletter.

As usual, first let’s take a look at the state of the US economy. Chairman of the Federal Reserve Powell told us, "The U.S. banking system is sound and resilient” and he believes the banking issues are a contained issue although fears are now spreading to Deutsche Bank and First Republic. I do believe these issues are still maintained.

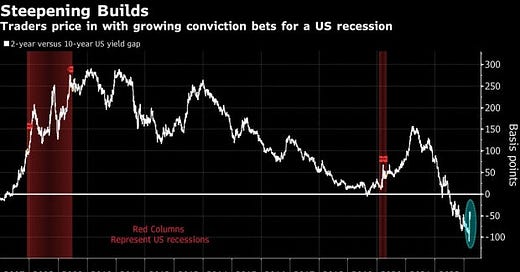

In the bond market, we can see how traders are expecting rate cuts this year, which is interesting because Powell did say to not expect any of those in 2023, but the bond market does not believe him.