Weekend Wall Street #35 - Bank Runs, FOMC, Bitcoin and Top Trades for 3/20-3/25

By continuing to read, you agree to the disclaimer at www.aditdayal.wix.com/disclaimer.

Happy Sunday traders! Last week was full of volatility with an inflation number coming in in-line with expectations, a job report showing inflation cooling, and an outperformance of stocks in the tech index ($QQQ) versus the S&P 500.

Next week is going to be a huge week, with the Federal Reserve making its decision on interest rates at the meeting on Wednesday, which will also feature a conference from Chairman Jerome Powell.

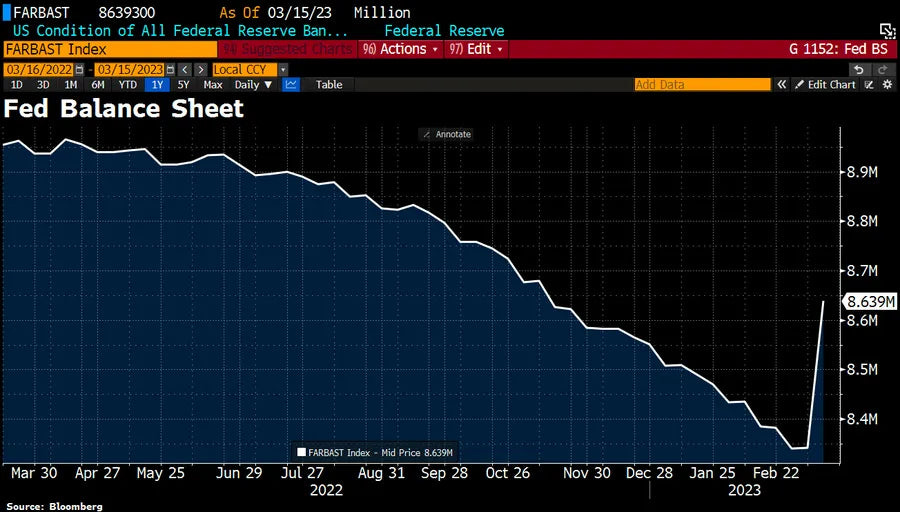

Last week, we also saw a rise in commercial bank reserves from the Fed, which was necessary in order to keep the baking system stable.

As I mentioned in last weeks newsletter, the reason there is so much financial stress is because of how regional banks were over positioned in low yield bonds, which have now lost their value, so these banks are seeing withdrawals, causing a bank run.

In fact, Warren Buffet has been in talks with the Biden administration in order to invest into the regional banking sector. In 2008, Buffet invested $5B in Goldman Sachs, and the same amount in the Bank of America in 2011, so this is not something that is new to him. Both of those investments paid off in the end, so I’d watch for news on this.

The Mid-Sized Bank Coalition of America (MBCA) has sent letters to the FDIC requesting that all deposits be protected for the next two years as well. This would give stability to the banks that need it right now.

This all leads back to one main point - what is the Federal Reserve going to do in regards to policy?