Weekend Wall Street #25 - Best Trades for 1/9-1/13 and S&P 500 Plan

By continuing to read, you agree to the disclaimer at www.aditdayal.wix.com/disclaimer.

We have a great week upcoming with lots of opportunities for us!

Let’s start by taking a look at our economic calendar:

As you can tell we have a lot of important economic events. #1 is going to be Fed Chair Powell on the 10th as his words give the sentiment on what the fed may do that numbers cannot. #2 is one of the most important data releases and it’s the CPI inflation number. To prove that the Fed’s plan is working, they must focus on inflation.

Last week, the market reacted well to the Job numbers, proving that the economy can handle absorbing higher interest rates without affecting employment.

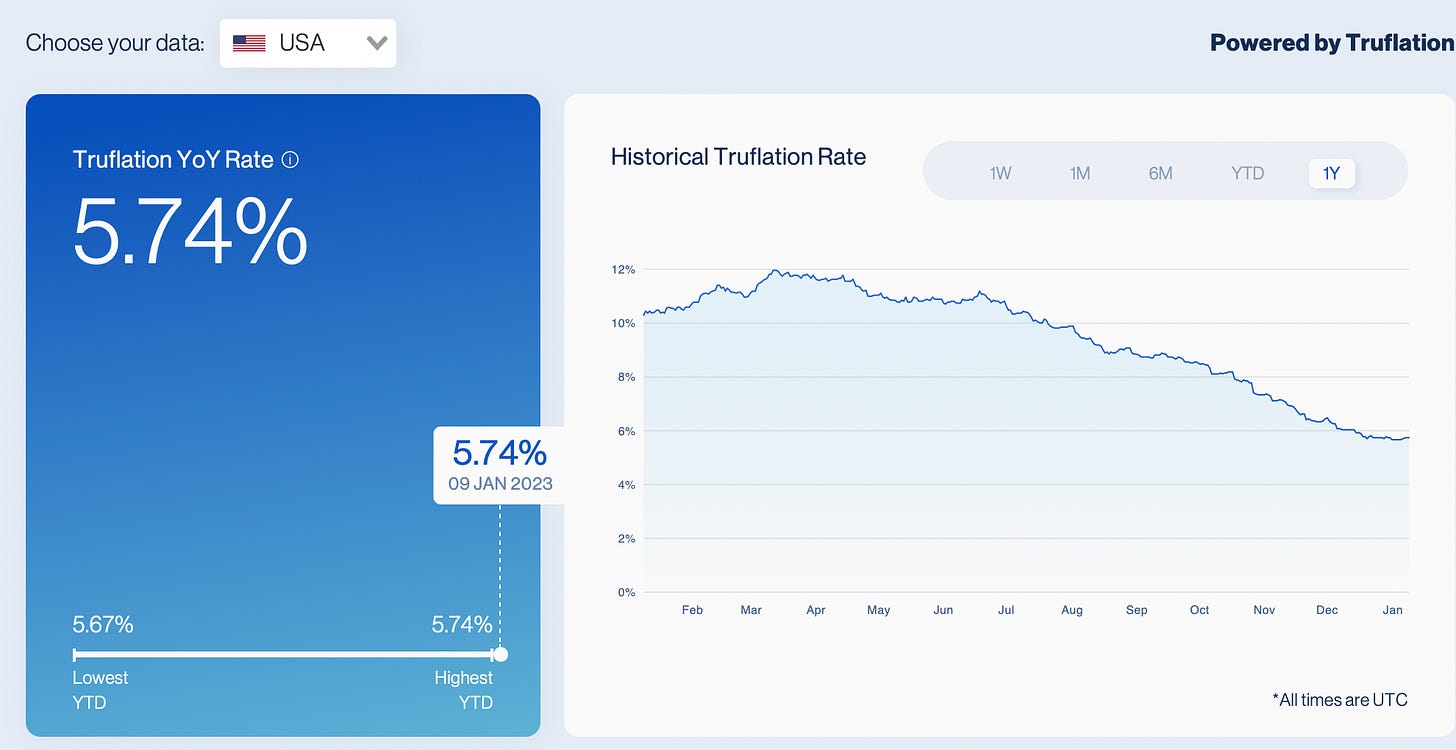

One source that I always look at is the “Truflation“ reading which is a private inflation reading and usually predictive of how the CPI number may turn out.

The Truflation reading has been on a steady decline over the last year, over 50% off the highs which is a great sign.

But analysis and opinions don’t do anything for the market, orders do.

In my opinion the best way to trade is to wait for confirmation of buyers/sellers pushing strong support and resistance.

S&P 500 Trade Plan (SPX, ES_F, SPY)