Weekend Wall Street #23 - Best Trades for 12/19-12/23 + Announcement

By continuing to read, you agree to the disclaimer at www.aditdayal.wix.com/disclaimer.

Less than ten trading days left to the end of the year! We have some great setups and opportunities going into next week for us.

I also have a big announcement:

This Friday, I will be releasing my 15 Trades for 2023 right here on my Substack for subscribers. It will include my macro outlooks and how that will affect the market, sectors I think will grow, and fifteen individual stocks with price targets and stop losses. If you’d like these trades straight to your email, subscribe below:

Now, let’s get into this week’s Weekend Wall Street!

Here’s our economic calendar, and luckily for us, there’s not much we need to be aware of this week in terms of announcements.

Now, let’s take a look at my S&P 500 Trade Plan for this week:

Long over $3956 with a PT $4142

PIVOT (aka bias is bullish or bearish when we trade under/over this level) at $3868

Bearish under $3810 with a PT $3723

Remember, the way I trade this is I was for a daily candle close over the level and I swing to the price target. If I see a clean reject of the bullish/bearish level, I take a trade with the opposite side for a day trade.

The three best ways to play these levels:

SPY 0.00%↑ or SPX call/put options with 1-3 days to expiry

SPXL 0.00%↑ (3X Bullish S&P 500 ETF) or SPXS 0.00%↑ (3X Bearish S&P 500 ETF)

Calls on a stock which is bullish and waiting for the SPY index to breakout or puts on the opposite side.

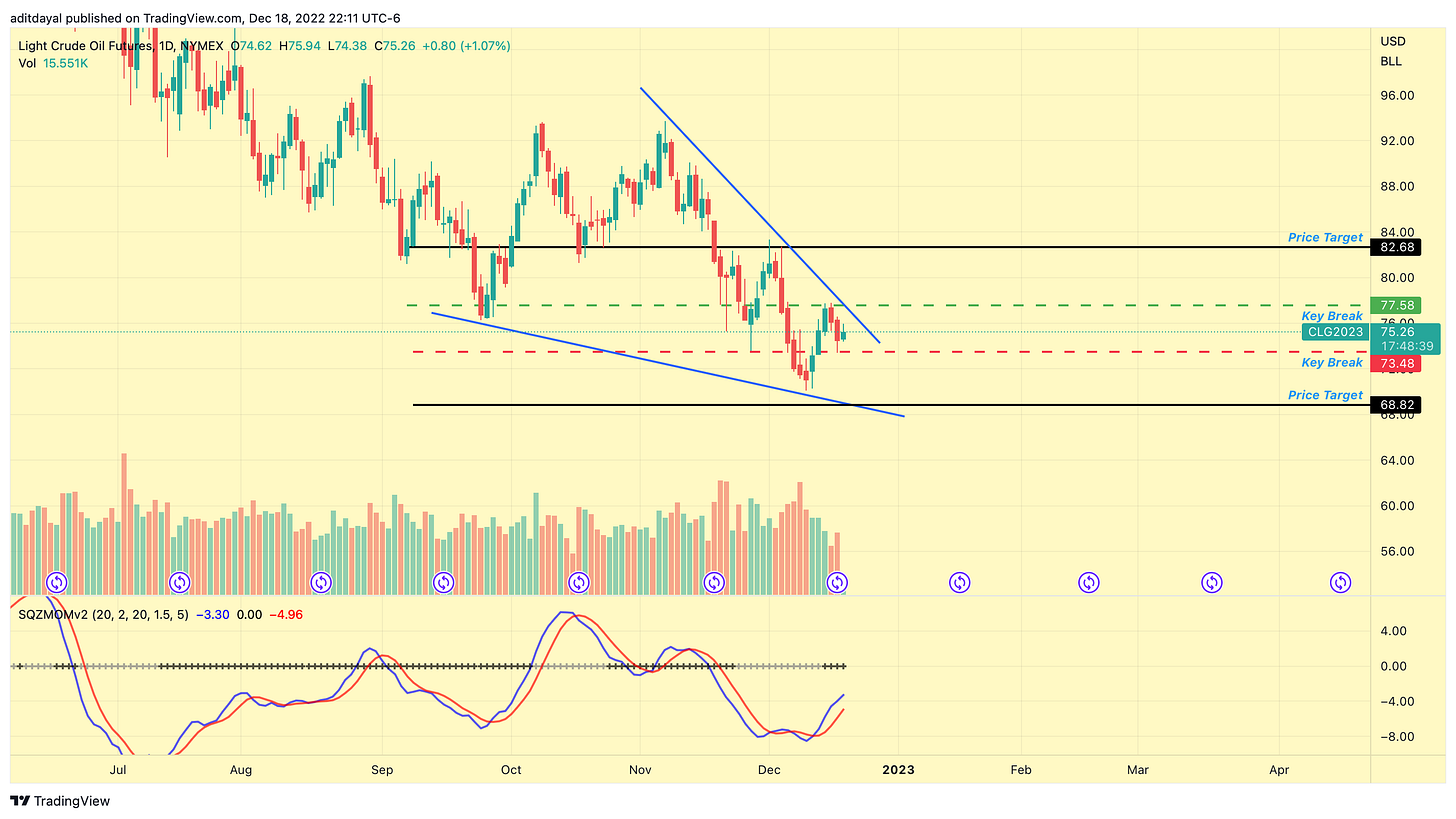

Here is my analysis on Crude Oil Futures and their levels:

Bullish over $77.58 with a PT $82.50

Bearish under $73.50 with a PT $68.785

Now, let’s get into my top individual setups for this week.