Weekend Wall Street #21- My Favorite Trades for 12/5-2/9 and S&P 500 Game Plan

By continuing to read, you agree to the disclaimer at www.aditdayal.wix.com/disclaimer.

Good evening everyone! We have a great week coming up, especially with the Fed Blackout period (aka the Fed is not speaking at all this week).

We ended last week super strong with my alert of PXMD 0.00%↑ which should have made everyone a lot of money from my alert at $2.25/sh. It ran up to over $3/sh on Friday!

You can read that article below:

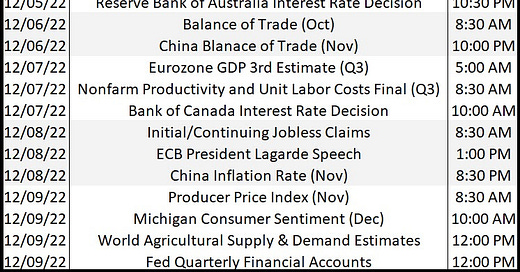

Now, for the upcoming week. Here’s the economic calendar:

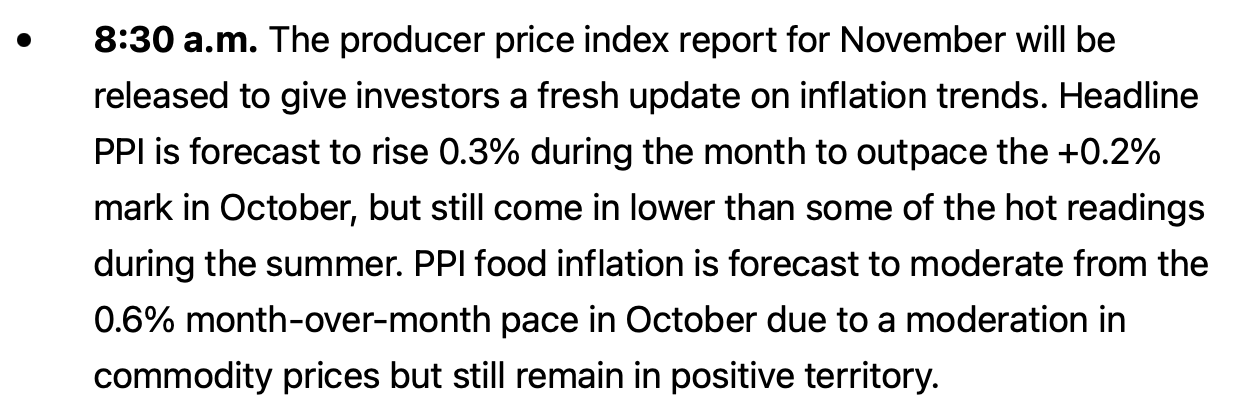

Nothing as crazy as last week, but keep your eye on the jobless claims on Thursday morning and the PPI number on Friday morning.

Remember, one key trick I like to look at is their Truflation number (a private reading of inflation numbers) and see where that is. It is usually very predictive in telling where the inflation numbers will go, especially as we close out the year.

And here’s the good news: it’s at the lowest it has been at 6.27%!

In fact, we can read deeper into the Truflation report and see that the food sector is -1.70% from what it was a month ago

This leads into my analysis of the S&P 500 index, which can be traded through various instruments depending on your risk tolerance. $SPX or SPY 0.00%↑ options contarcts, SPXL 0.00%↑ (3X Leveraged S&P 500 Bull ETF) and SPXS 0.00%↑ (3X Leveraged S&P 500 Bear ETF) are two ETF's to trade if you trade shares.