Tuesday Updates, Powell, and Low Floats/Shorted Stocks

By continuing to read, you agree to the disclaimer at www.aditdayal.wix.com/disclaimer.

Good evening everyone. Powell spoke hawkishly today with all the major indexes closing near -1.5%. In fact Powell said that “…the ultimate level of interest rates is likely to be higher than previously anticipated."

Obviously the market did not like this and Powell will be speaking again tomorrow at 10:30 in front of congress along with the JOLTS economic numbers.

That means volatility and unless you are hedged I would stay away from opening any large positions.

Goldman Sachs has raised their forecast for peak Fed Funds rate to be raised to 5.5-5.75% (which I predicted in my weekend newsletter).

One way to play this is via. $SOFR futures options.

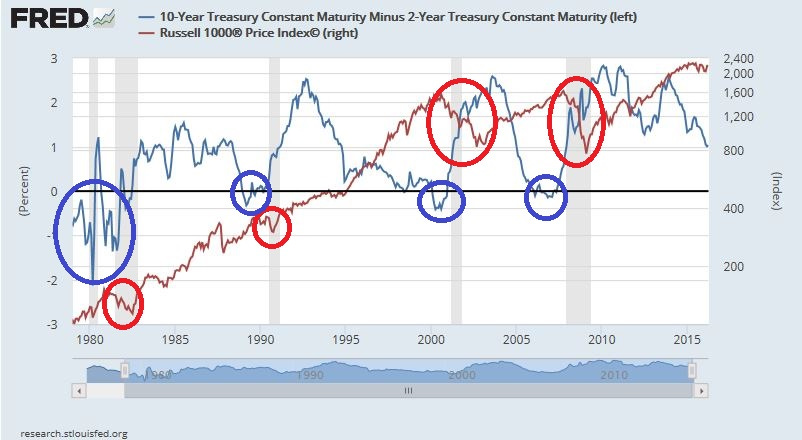

Lastly in terms of macroeconomics is the bond yield inversion which is the spread between 2Y and 10Y bonds which has increased to the highest it’s been since the 1980’s. This basically means the bond market is not expecting a soft landing but rather a recession

As seen in the chart above, it’s generally agreed upon that a yield curve inversion precedes recession by ~12 months.

Lastly, money has flowed into the US dollar which is generally a “safe spot“ for investors to park cash and therefore a headwind to stocks