Thursday Night Updates (3/30/23)

By continuing to read, you agree to the disclaimer at www.aditdayal.wix.com/disclaimer.

Good evening traders. The market gapped higher today and is looking very strong, but tomorrow morning we have the PCE number which is the Fed’s preferred inflation gauge. Analysts are expecting a 4.7% YoY rise.

I took some time today to read Nomura Investment Bank’s quant research statement. Here are some of the key highlights:

📈 US equity markets rose last week, with the S&P 500 up 1.4%. Despite the still-pervasive worry over financial instability, the index has managed to log small gains in each of the past two weeks.

💸 Short-covering by CTAs appears to be a major factor in the recent US equity market gains. CTAs covered short positions last week and are expected to continue substantial net buying of futures for the time being.

🤔 However, macro hedge funds are likely to keep their exposure to US equities fairly limited for now. There are doubts about the sustainability of the upward momentum, and macro funds are waiting for a bullish market trajectory before extending their net long position.

📉 Implied volatility in the US bond market remains high, which is a key factor affecting macro funds' exposure to US equities. The remaining difference can generally be explained by the past one-month return.

🔮 It remains to be seen whether the near-term market trajectory will be bullish enough to encourage macro hedge funds to increase their net long position.

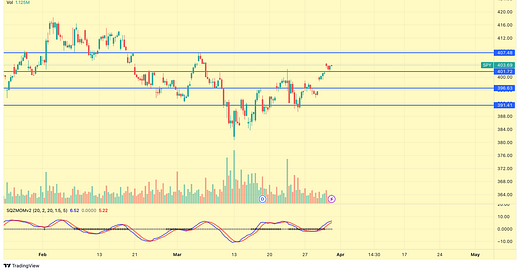

JPM Collar

Tomorrow JP Morgan will place their famous collar trade. As usual, I will be watching the options flow and will post the trade when it’s placed and I see it on the tape.

How is this important and how will it affect the market?