Three Small Cap Swing Ideas

By continuing to read, you agree to the disclaimer at www.aditdayal.wix.com/disclaimer.

Good evening everyone! Let’s start off with an overall recap of the market:

Some hot names today:

COIN 0.00%↑ - which is one of our swing trades for 2023 and which I highlighted in yesterday’s Weekend Wall Street as a possible short squeeze is up +40% over the last few days at one point and CNBC cited it as a short squeeze stock! Obviously they did it after the fact, though I told you about it yesterday. I still am holding the swing shares as I believe this can move further, but what a start!

Word on the street is that CVS 0.00%↑ is planning on purchasing OSH 0.00%↑ . This is interesting because just last year CANO 0.00%↑ was a huge buyout target for CVS 0.00%↑. CANO 0.00%↑ is trading higher and saw call flow today as you can see below:

Meme names today gained including PRTY 0.00%↑ (Party City) and BBBY 0.00%↑ (Bed Bath and Beyond).

Lastly, in my predictions for 2023, one might have thought I came from the future. One trade was to go Long MSFT 0.00%↑ because of their investments in OpenAI and this morning I read the Bloomberg headline that their expanding their investments even further

If you would like my other predictions for 2023:

The S&P 500 gained heavy today off the lack of comments from Powell this morning:

71% of stocks in the market gained today which is very bullish because any number over 70% means that a majority of the stocks are advancing and it’s not a few stocks carrying the market.

What Powell reiterated today was that to cool the economy, unemployment must rise and that won’t be popular with politicians, but he is adamant on staying on track.

The CPI number on Thursday is going to be crucial for market movement and where we will go next, here is JP Morgan’s predictions on what the market will do based on the CPI number:

Here are some key levels to watch on SPY 0.00%↑ :

$403.11 (PT on bullish CPI number)

$395.60 (scalp level)

$389.20 (scalp level)

$381.98 (bearish target)

My full plan is the same I have in Weekend Wall Street.

Today I’m writing to share some longer term swings that I have done some research on for a few small caps that might interest you.

Let’s take a look:

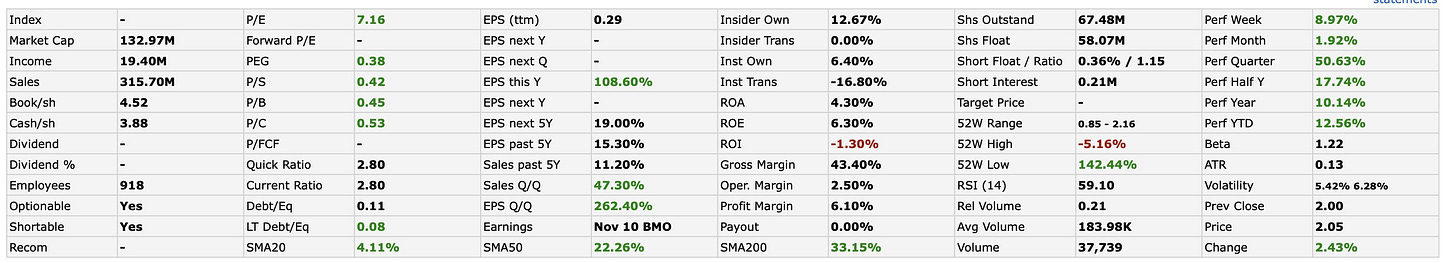

#1) Long XNET 0.00%↑ . Strong accumulation here at $2, but we also have consistent quarter over quarter revenue growth and it’s fundamentally very strong. It has $3.88 in cash/sh (trading below cash which is good), Book/sh val of $4.52, P/E of 7, PEG of 0.38. These are all good but I'm also interested in the fact that it's grown EPS so strongly and revenue as well in this market. PT $5 SL $1.70.

#2) Long PERI 0.00%↑ . This is one way to bet on the success of ChatGPT and here's why Since Microsoft MSFT 0.00%↑ is investing in OpenAI, they may integrate ChatGPT with Bing Perion is the strategic partner of advertising on Bing. Therefore if Bing usage skyrockets, so will advertising via PERI 0.00%↑ . 42 SL 24.

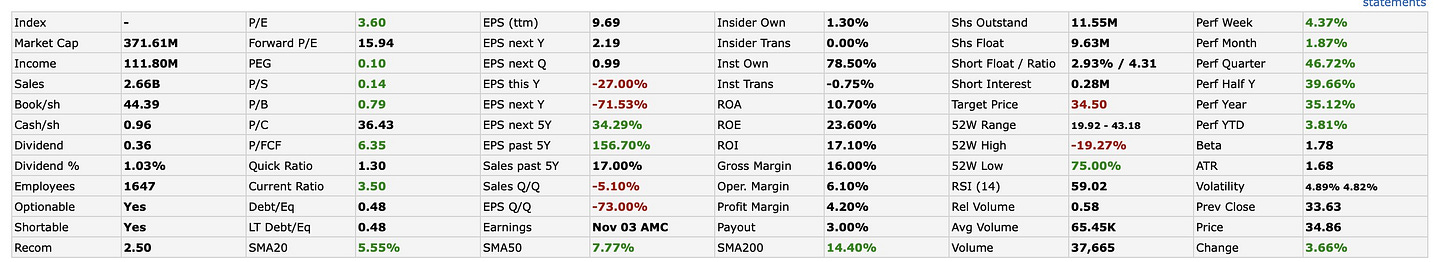

#3) Long ZEUS 0.00%↑ . Steel may be expected to rise in 2023 especially as China is reopeneingand they are the number one consumer of steel. This small cap is a steel play and also it's very strong fundamentally and is in a bull flag as well. Book val. of $44, P/E of 3.60, PEG of 0.10, low debt to equity, they pay dividend. If steel is in play, this one can move. PT 50 SL 30.

Top Options Sweeps Today

Top Shorted Stocks via S3 Data

PIK 0.00%↑ - 88% SI

GROM 0.00%↑ - 54% SI

BBBY 0.00%↑ - 52% SI

SI 0.00%↑ -52% SI

PXMD 0.00%↑ - 51% SI

APRN 0.00%↑ - 48% SI

BYND 0.00%↑ - 45% SI

Notable Insider Buys

HOWL 0.00%↑ - $4 million buy in a $2 stock

That’s it for this article, I hope you enjoyed. I will have more trade ideas and education out after the CPI number.

Thanks for reading,

Adit Dayal