The Moon Gets Closer, Chinese Purses, and J-Pow

By continuing to read, you agree to the disclaimer at www.aditdayal.wix.com/disclaimer.

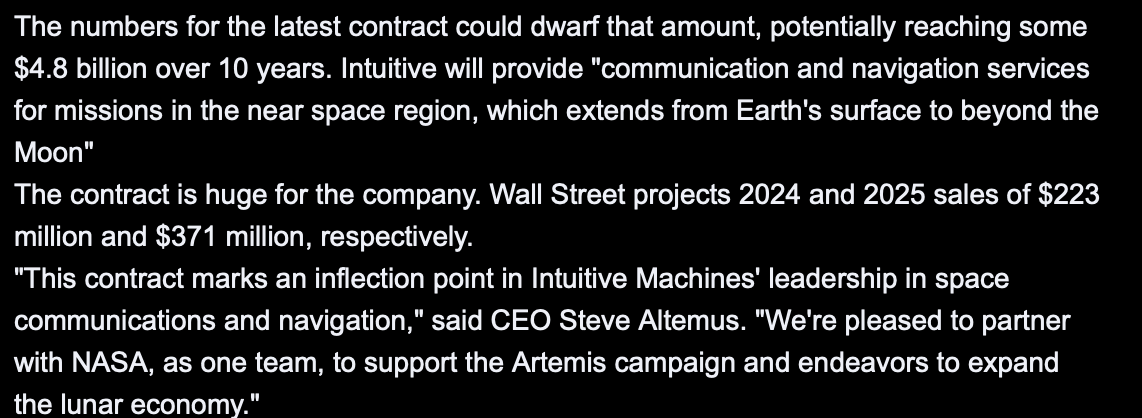

A couple weeks ago I sent out LUNR as a stock pick:

This was an interesting one, I had noted that they were likely to get a NASA contract and the stock hadn’t been pricing it in.

The stock was trading at $4 during my time of mention, but by the time the next day had hit, we made over 1000% on it. Well- the thesis finally, fully, and beautifully played out:

The name is up 56% after hours and, from our original entry at $4.25, this was a trade that made my month.

I hope those that tailed enjoyed, and there will always be more opportunities. Do you get overconfident after a big trade? I sure do, so I’ll size smaller. Know your limits.

What is arbitrage? The textbook definition “the simultaneous buying and selling of securities, currency, or commodities in different markets or in derivative forms in order to take advantage of differing prices for the same asset.“

Basically:

you buy something where its cheap

move it to where its expensive

pocket the difference.

Sounds pretty easy, right?

Well in China, luxury goods mean a lot. And for that reason, the average markup for a luxury good in China is around 23% while in Japan it’s only 2%. Sounds like arbitrage right?

Well it is! It’s known as the “daigou market” aka in Chinese 代购 → to replace and to buy. Basically, agents outside of China buy things on behalf of Chinese customers, mark it up, and get it back to their client in China. Very fascinating stuff. It actually started with baby health products and has led into the multi billion dollar economy we live in today.

“I mean, for your image, there is nothing worse. It’s dreadful” - Bernard Arnault

But it’s not just amateurs doing this: department stores with excess inventory, people buying in wholesale to ship it back- and the government is cracking down. The companies don’t like it and the buyers don’t pay tax. I mean, the biggest part of a luxury brand is exclusivity which is just a derivative of price, so when you have people flooding the supply with cheaper yet authentic models of an item, I can imagine someone being mad.

The LVMH weekly chart is also showing signs of slowing: China sales slowed while US sales picked up. We’ve heard the reports about a slowing economy in China, and this is just a another reason it’s not good for these brands.

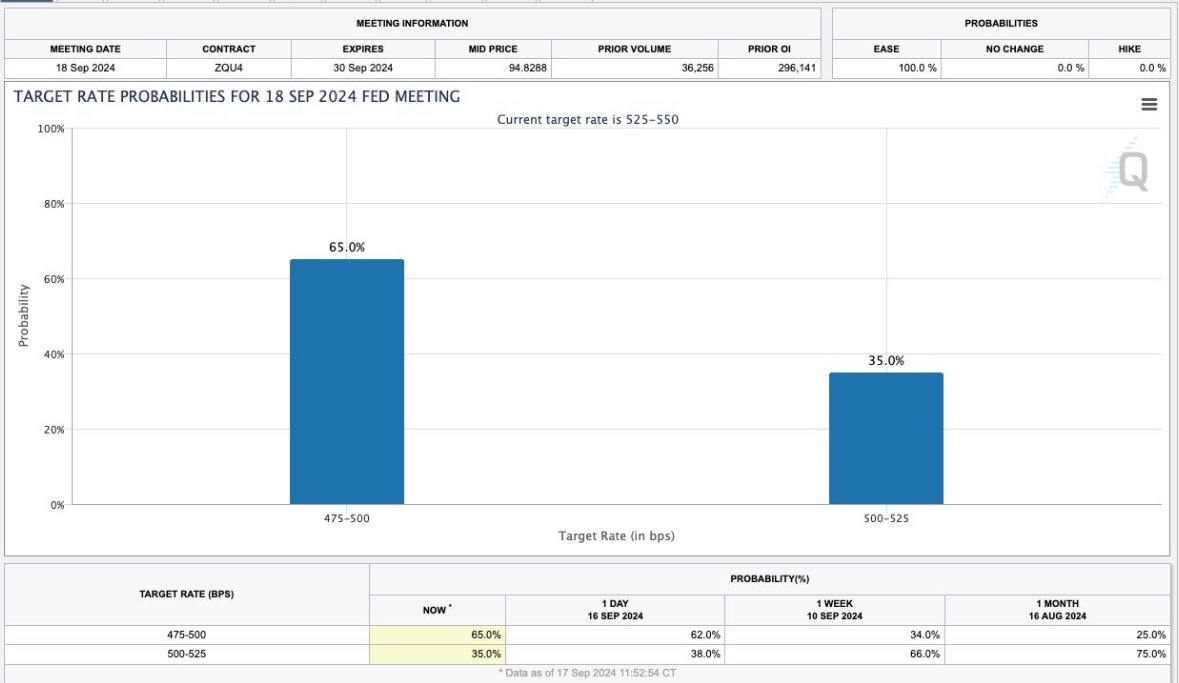

Tomorrow is the big day: rate cuts!

This has been the most the market is undecided in over 15 years:

In fact, my last article talking about this had decidedly said that we’re going to settle on 25bps, but a couple articles from the WSJ and Financial Times this week completely spun that argument.

JP Morgan is in the 50bps hut, but Adit remains in the 25bps. The Fed has proven to be late and patient with data, and the last thing they’d want would be to cut too early in an uncertain economy. Of course, I could be wrong, and that’s why I’m all cash :).

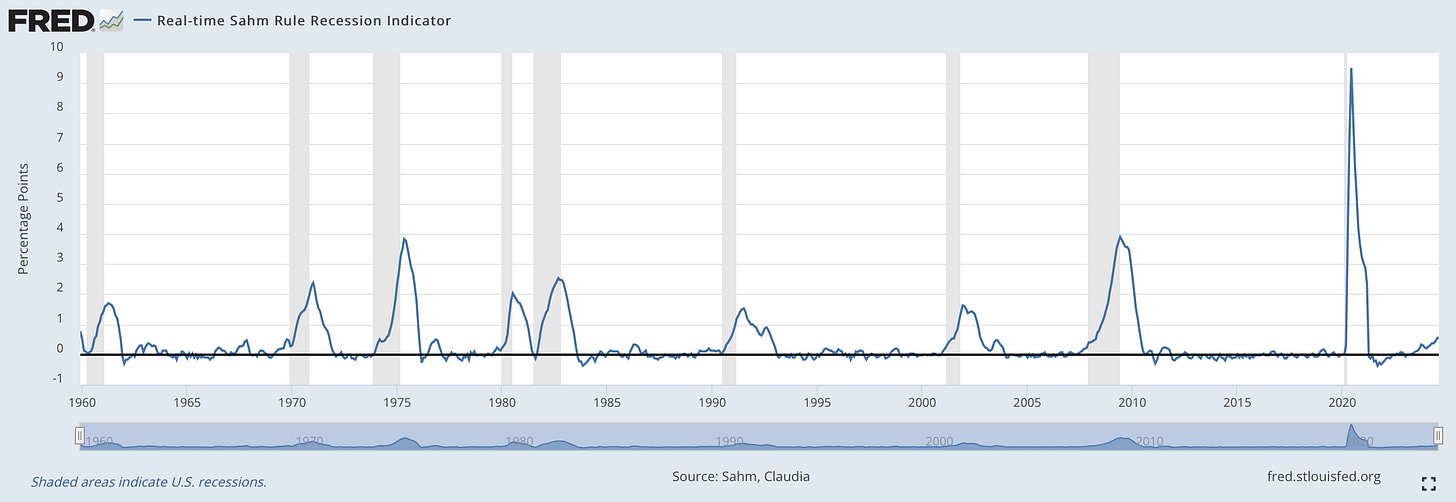

The Fed requires two things: price stability and keeping employment at a certain level. Unemployment has risen by 80bps since Jan 2023 and the labor market is getting worried that we may be going too far in the wrong direction.

See the Sahm Rule- “ identifies signals related to the start of a recession when the three-month moving average of the national unemployment rate (U3) rises by 0.50 percentage points or more relative to its low during the previous 12 months.”

This was recently triggered.

On the other hand, the Fed has been, and probably will be, fooled by inflation numbers and be too late to the game.

What they will do is going to be a great time to see. Polymarket odds have the 50bps cut at a 57% chance of happening.

I’m excited to trade tomorrow.

From Alpha Trader: don’t be scared of times like these- you can’t sit out on volatility. Position smaller and be tactile.

Thank you for reading and have a good luck trading!

-Adit Dayal