Some Trades for Earnings Week and S&P 500 Trading Plan

By continuing to read, you agree to the disclaimer at www.whitepagefund.com.

What a crazy volatile week with a lot of gaps making it difficult to trade when the volatility happened overnight, but there are still a lot of ways to trade which I will get into in a bit.

We have some amazing setups and I’ve included our $SPX levels, an options trade on a stock under $15, a day trade on a large cap stock, a small cap stock, and an earnings pick for tomorrow so we are still feasting!

Here are some catalysts for tomorrow:

Here’s an update on our S&P 500 trading levels:

They are working almost perfectly and today was a basing day for the market to digest the insane swings we’ve had as the price action was between our bullish level and our price target.

The key level to hold here is 3670. A close under that and a move back to the median at 3584 is likely. Over 3720 is where things get interesting for bulls as we have movement to 3800 likely.

Here are some other setups I liked today:

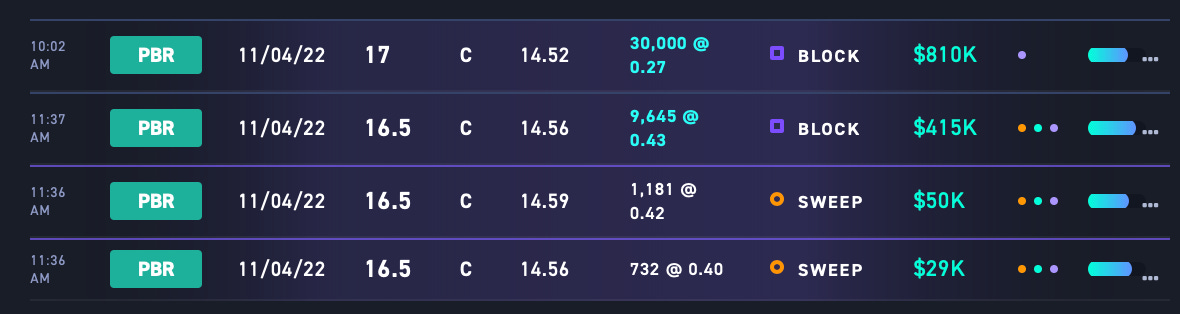

I like PBR 0.00%↑ call options today and so did the options flow. Biden did say he will buy crude oil when it gets a bit cheaper, which kind of sets up a floor for these oil names.

There are two ways I think you can play this:

PBR 0.00%↑ call options. The chart is great and the options flow is even better with way OTM buys on the 17C for 11/4. These are a cheap way to play this.

The second way, especially if you trade shares, is OILU 0.00%↑ which is the 3X Oil ETF. This ETF is in an inverse head and shoulders pattern with a breakout above 55.

One day trade I think can work tomorrow for a scalp is to play TSLA 0.00%↑ puts after earnings as options will be very cheap. The chart is in a bear flag. The reasoning behind this is two fold:

Elon really tried pumping TSLA 0.00%↑ today on the investors call, but it was to no avail for investor which shows extreme weakness in this stock.

Since TSLA 0.00%↑ options contracts didn't make their implied move, the premiums will crush tomorrow morning as bagholders sell their worthless options and they will be much cheaper than they were today.

One small cap stock to trade is LASE 0.00%↑ . This has had unusual volume since it's gapped from $1.50 to $5.50 and is in a bull flag right now. This is one of those names that's super volatile so preferable not an overnight hold and rather a daytrade name with a tight stop loss. PT 6 SL 3.

My last trade for this week would be an earnings trade on SNAP 0.00%↑ . A cheaper way to play this is via META 0.00%↑ call options since they are a sympathy trade

If you take a look at the Google Trends, the interest in snapchat.com has grown in the last quarter and the chart has a nice gap above to $16. The options flow has been great to so if you keep a line-in-the-sand over at $10 this may be a great trade.

Remember- earning plays are almost always unpredictable so make sure to size only what you can lose, no matter the conviction level. Especially with options where you can lose even if you are right due to implied volatility.

One lotto that’s cheap is the SNAP 0.00%↑ 12/12.5/13/13.5 call spread for next week.

Essentially you buy the 12C and the 13C and you sell the 12.5C and the 13.5C.

It costs 24 cents and if SNAP 0.00%↑ is above $12.50 by Friday's close you make $26 and if we get a blowout earnings and it's above $13.50 you make $76 on a $24 option.

Hope these trade ideas helped, I will see you all on Friday!

If you have any questions throughout the week, feel free to email me at adit@whitepagefund.com.

Thanks for reading,

Adit Dayal