My 2023 Trading Update (and Returns) - "Adit's Alpha"

By continuing to read, you agree to the disclaimer at www.aditdayal.wix.com/disclaimer.

Good evening traders. As we close off the 2023 year I want to thank you all for your continued support reading my articles.

A few key updates. The first is that I’ve made my newsletter completely free to all traders who want to read it. If there is any article that for some reason still has a paywall, please email me at adit@whitepagefund.com and I will fix that for you.

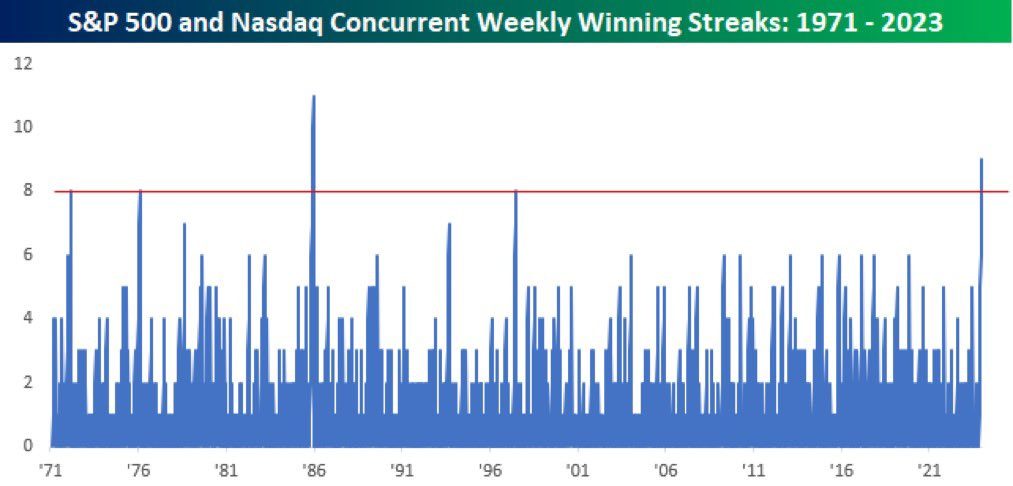

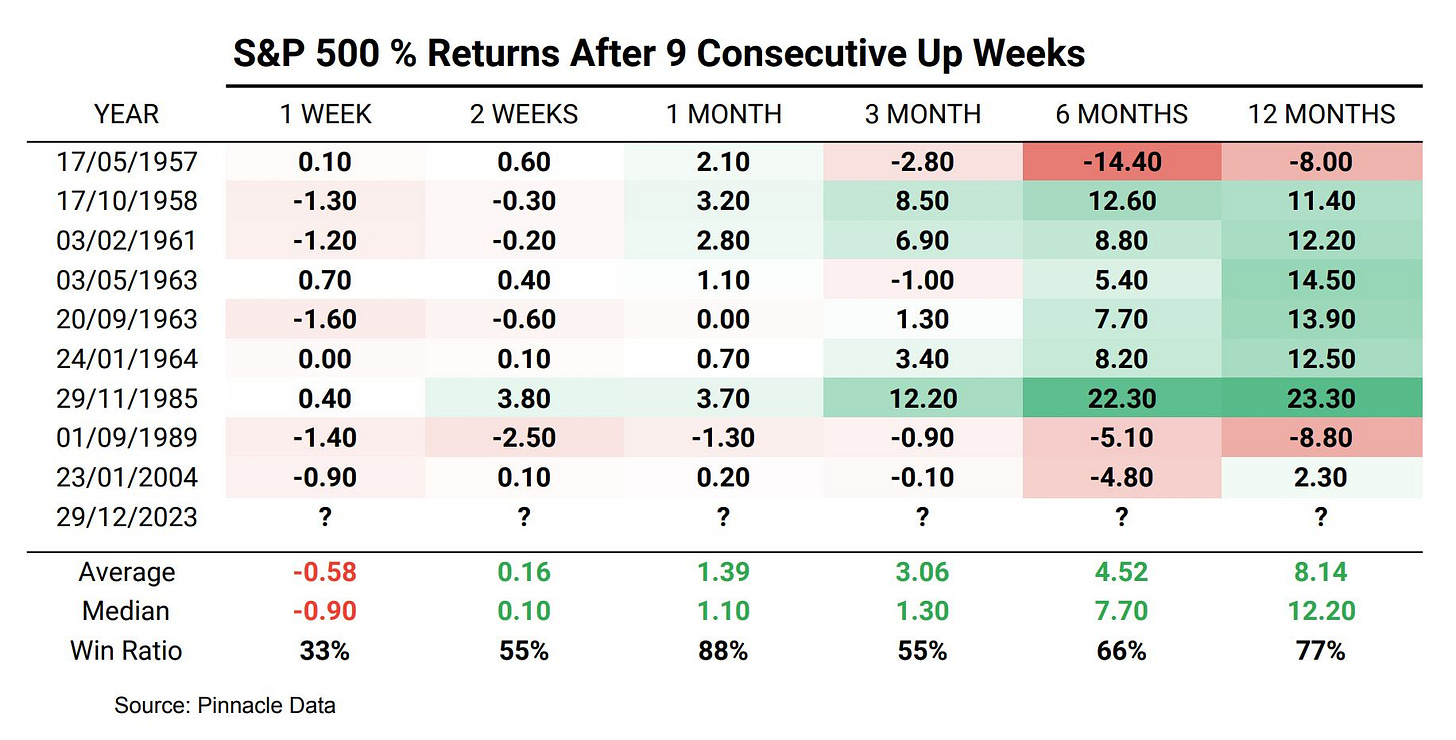

Second, this has been an amazing year for the stock market. In fact, we just closed green for the ninth week in a row, a 20 year record.

Over the next 12 months, there is a 77% chance we end up green again. Follow momentum.

Although the market may have been green, the risk we take on taking individual bets may not reflect the overall market, so to those that ended the year red I advise to keep pushing forward. Trading is not, and will never be free and easy money (no matter what the TikTok gurus say) so please keep discipline and stick to your trading plan.

Mine will continue to be taking a few trades of the same setup over and over again with tight risk. Theme based plays with both catalyst and technical reasons to provide amplified return.

Now for what we’re all waiting for: my 2023 portfolio returns.

Last year, I published “My 15 Trades and Predictions for 2023“ (which you can read at the link below) in the troughs of the bear market:

My 15 Trades and Predictions for 2023 (with PT and SL)

What a year this has been for the stock market with the closing nearly $100 or 21% lower than where we were last year as I write this article. Lots of issues caused this bear market: high inflation, …

This portfolio returned a stunning 67.97% on shares INCLUDING our hedge (which was our lowest performer). Our highest return was on Coinbase with a buy at $35.59 and a closing price of $173.92 or 391% and our lowest return was on Hasbro with a return of -16%.

From nearly the beginning of January the addition of higher volatility, but on theme names generated outperformance throughout the year. I like to call this outperformance the “Adit Alpha“ gap 😉.

The beta of the overall portfolio is 1.3 indicating higher volatility relative to the market but this added volatility was essential in generating the alpha we did.

I did some napkin math to calculate a Sharpe ratio of 6.21 (used 4% for the risk free rate and SD of the portfolio of 10.3%) indicating that we had some very strong risk adjusted performance this year.

I hope you all enjoyed reading my articles as much as I loved researching for them and I cannot wait to see you all again for what should be a very fun 2024 for the markets.

Please consider sharing my newsletter (it’s free) so I have motivation to keep making them haha.

Thank you and have a great New Years,

-Adit Dayal