My 15 Trades and Predictions for 2023 (with PT and SL)

By continuing to read, you agree to the disclaimer at www.aditdayal.wix.com/disclaimer.

What a year this has been for the stock market with the SPY 0.00%↑ closing nearly $100 or 21% lower than where we were last year as I write this article.

Lots of issues caused this bear market: high inflation, the Russia-Ukraine war, and more all caused pain for investors this year. But where will these issues take us next year?

Here are the top investment bank predictions for the S&P 500 for 2023.

On average there’s not a lot of directional bias, and many think we will stay flat. This is reminiscent of “The Lost Decade for Stocks“ which is when the stock market produced zero return from 1999 to 2009, meaning money put in the stock market actually deteriorated in value due to inflation.

I personally believe 2023 will end green. There are a few reasons for this which I will further dive into now:

Unlike previous bear markets, the retail and average American has been trained to buy the dip, meaning the stock market is a lot more forward looking than it has been before- investors are looking to buy low and sell high on any good news.

Much of the issues that led to the 2022 slum in stocks are working to be resolved: inflation is cooling significantly, China is doing a lot of reopening, and innovation continuing in many areas, despite high inflation.

Historically, after a market bottom there are significant returns after one year:

Let’s talk specifics.

My prediction for next year (once again, nothing is guaranteed and it’s very hard to time the market), but I think the beginning of the year will be this chop/downtrend that we’ve been seeing these last few weeks in 2022 and then we will trend upwards.

The reason I think this is because though inflation is cooling, we may be seeing an earnings recession as companies fail to bring in customers and high growth stocks still have a lot of room down (stocks like FSR 0.00%↑ and WE 0.00%↑ ).

Lots of names in good, upcoming industries like AI and EV are all beaten down heavily and will provide massive entry opportunities in my opinion. I especially don’t see companies like Rivian going anywhere, I think they’re just getting started. Note: all charts are weekly charts since these are not short term day trades but rather swings, the price targets and stop losses have no set date they are just there.

Before I start, I’d like to know your top pick for 2023, which you can leave below:

Now, let’s get into my 15 trades for 2023.

#1) Long RIVN. This is a stock that I think has a lot of room to the upside here as the EV market is continuing to grow. Many analysts think the price of oil will increase in 2023 and this will just further push the EV market. Even the US law is moving forward In the U.S. Senate, Sens. Chuck Schumer and Joe Manchin have proposed extending a $7,500 tax credit for new EV purchases and a $4,000 tax credit for used EVs. The best part about this company is that they have huge investments from Amazon (owning ~30% of the company) and they have a lot of cars on the road. Rivian even provided Amazon with the vehicles for their December holiday deliveries. PT 55 Sl 11.

#2) Long MAR. I think the hotel business will continue to expand as options like AirBnB and rentals get too expensive, especially as the housing market refuses to cool, these hotel businesses like Marriott have been basing and accumulating for a while, and this may be the year they finally have the next leg up. PT 250 SL 120.

#3) Long UDMY. Udemy is an online learning platform with hundreds of thousands of courses. One trend I have noticed recently is the increasing cost of education through traditional facilities like a college, but the increased need for serviced based employees (developers, accounting, etc.) and Udemy provides certification for all of these. They are exceeded to have a 40% YoY revenue growth and are flush with cash ($500M) and no debt. PT 17 SL 6.

#4) Long ROST. Ross is a discount store and these discount stores should have a stellar 2023 as we enter a recession but the demand for name brands is still high, these places are exactly where people will end up going. The reason I believe the P/E ratio is high is because the value of owning this stock in times of recession as it should be able to perform just as well in any scenario.

#5) Long IONQ. One sector that has kind of blown over everyone’s heads recently is quantum computing. As companies and AI expand and they try to solve more and more problems, this is the first pure quantum play on the market and I believe the industry will only continue to grow. Quantum computing is expected to grow to a market size of $450-850B within the next 15-30 years. IonQ claims to have the highest performance quantum computer. This is a very speculative trade but can multibag over the next 5 years if this industry moves. PT 10 SL 2.50.

#6) Long MSFT. Another expanding industry is the AI and everyone knows about OpenAI and their ChatAI software. The CEO said revenue was to be $1B by 2024 and Microsoft happens to have a lot of investments with them. If 2023 is the year AI starts to go, this name should benefit from it

#7) Long GSAT. Apple recently announced satellite communications would begin this year for the new iPhones and their main provider is Globalstar (which has given up all the gains it’s made since). I think this one should get headlines later in the year and bounce. PT 3 SL 0.70.

#8) Long U. Apple is planning on launching their VR and AR headsets this year based on an analyst I know that is very accurate and Unity is the main provider for 3D rendering game systems which will be in high demand therefore it should be a big winner as the meta verse continues to grow. PT 70 SL 15.

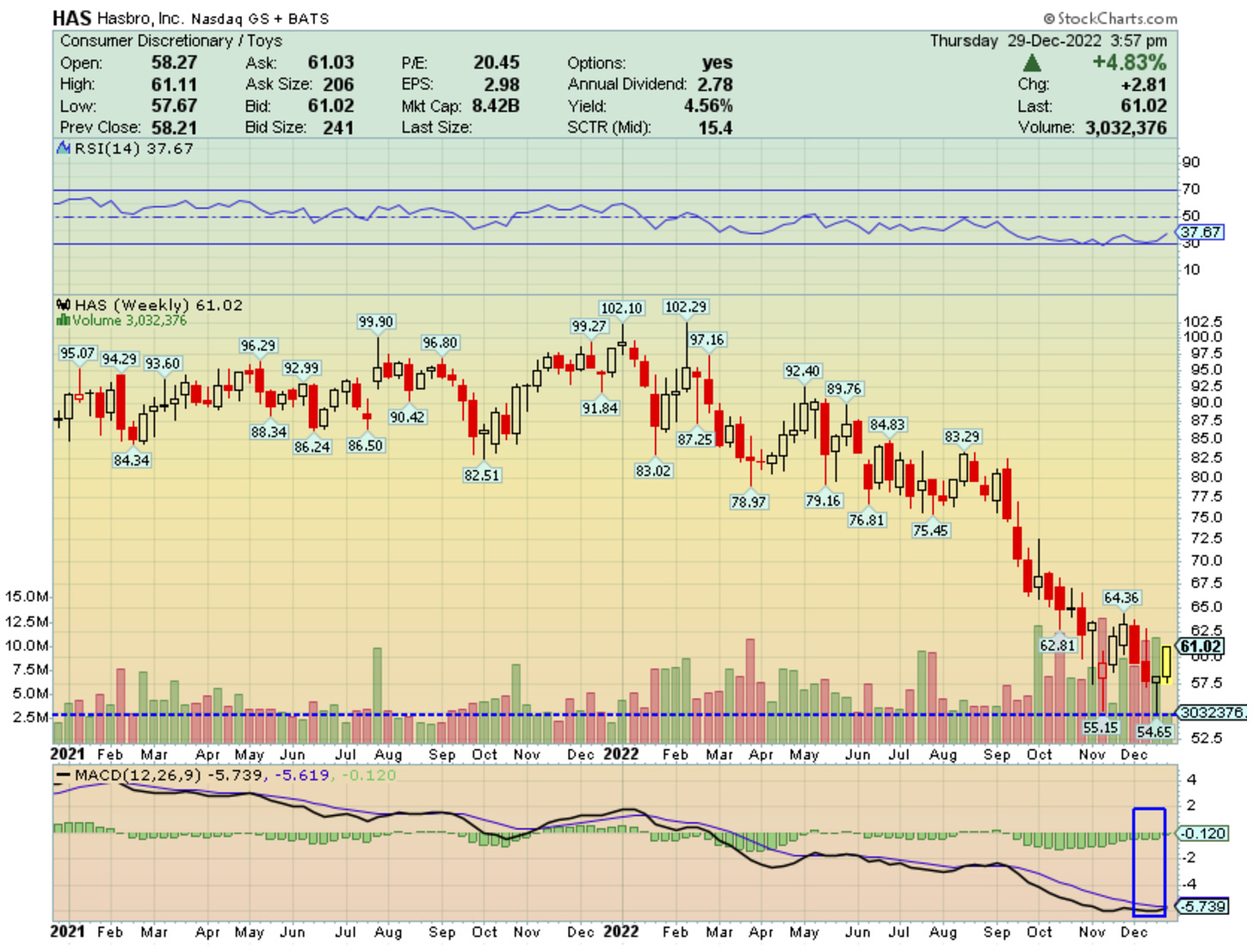

#9) Long HAS. 2023 is going to be a huge year for name brand movies, including Marvel and the best way to play these big superhero movies is through the toys that make them and Hasbro has been beat down heavy here which is why I am adding it to the list. PT 100 SL 45.

#10) Long DIS. Like I mentioned earlier, this is going to be a great year for movies and Disney has been heavily beat down. They just got Bob Iger back as CEO and have a lot going for them, especially if Netflix begins to lose steam, subscribers may move to Disney

.

#11) Long LILAK. This is a cable and Internet stock that operates in Latin America. I think that region will begin to grow and I also feel like if streaming services continue to raise prices, there will be a move back into cable TV. Another great part about this stock is that Michael Burry owns this name.

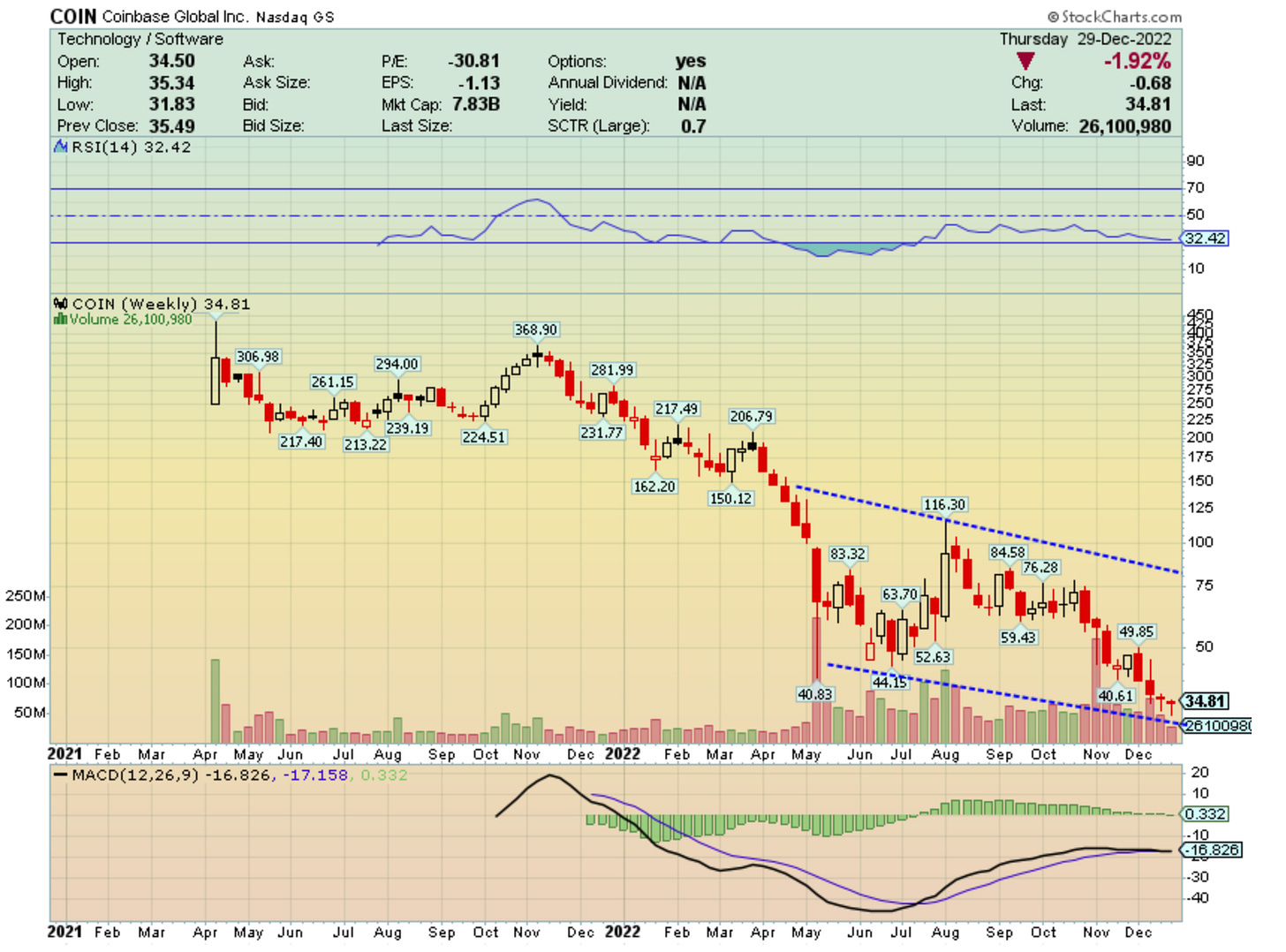

#12) Long COIN. Coinbase is one stock that should really move because I do think crypto will run again in 2023 and this is one of the only public crypto brokers. The reason I think crypto will find a bottom is because there is always a need for a unregulated money transaction and until the government regulates it, crypto will be the way that it’s done.

#13) Long CVS. As the flu season returns and minor sicknesses come back, CVS is a great pick for me because of their foot in the healthcare sector. They also have camera and printing services which I think will grow as well. PT 130 SL 75.

#14) Long HIMS. This company provides cheap healthcare solutions and as I mentioned this will become much more valuable as health issues grow, but things become more expensive. They also have large margins and are able to charge much more than competitors for their “premium“ recognition. PT 15 SL 3.

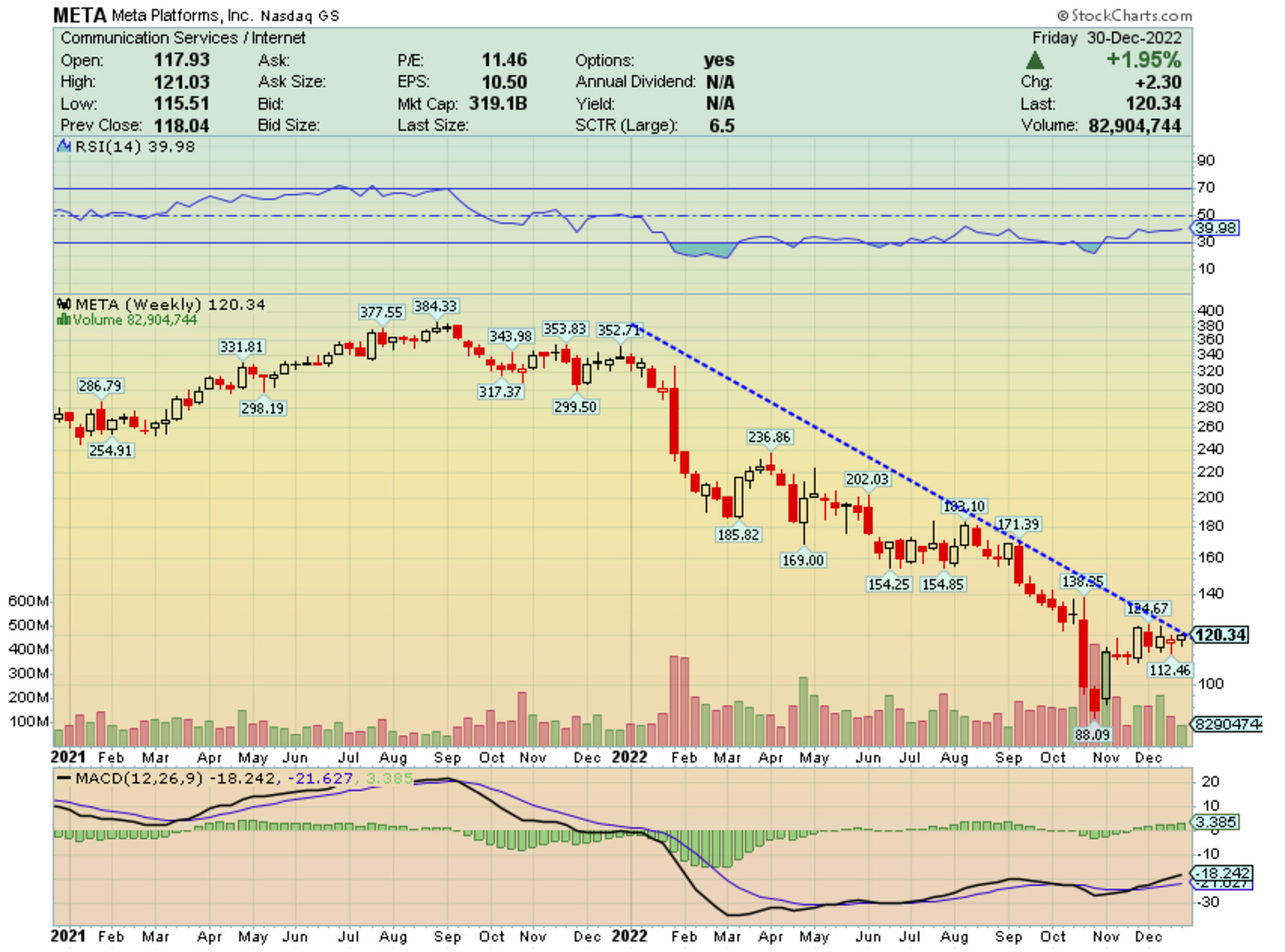

#15) Long META. At some point this year I think TikTok will be banned and Meta owns the main competitor, Instagram Reels. They are already proposing banning the app from government officials, so it is inevitable that there may be a headline that pops this stock later this year. It is also a large loser overall so it should bounce again

#16) Long SPXS. For my last pick I think it’s always good to have a hedge in place so I think this 3X Short S&P 500 ETF is the best way to have a hedge since it doesn’t require you to actually short anything.

As I mentioned earlier, I believe Q1 of 2023 will have some great opportunities to get into many names which have been beat down this year. Though bear markets hurt, history has shown that dollar cost averaging into dips usually will pay off. It’s also not a bad idea to dollar cost average into the S&P 500 itself. 70% into the S&P 500 and 30% into stock picks is never a bad idea if you’re not sure what is going to happen.

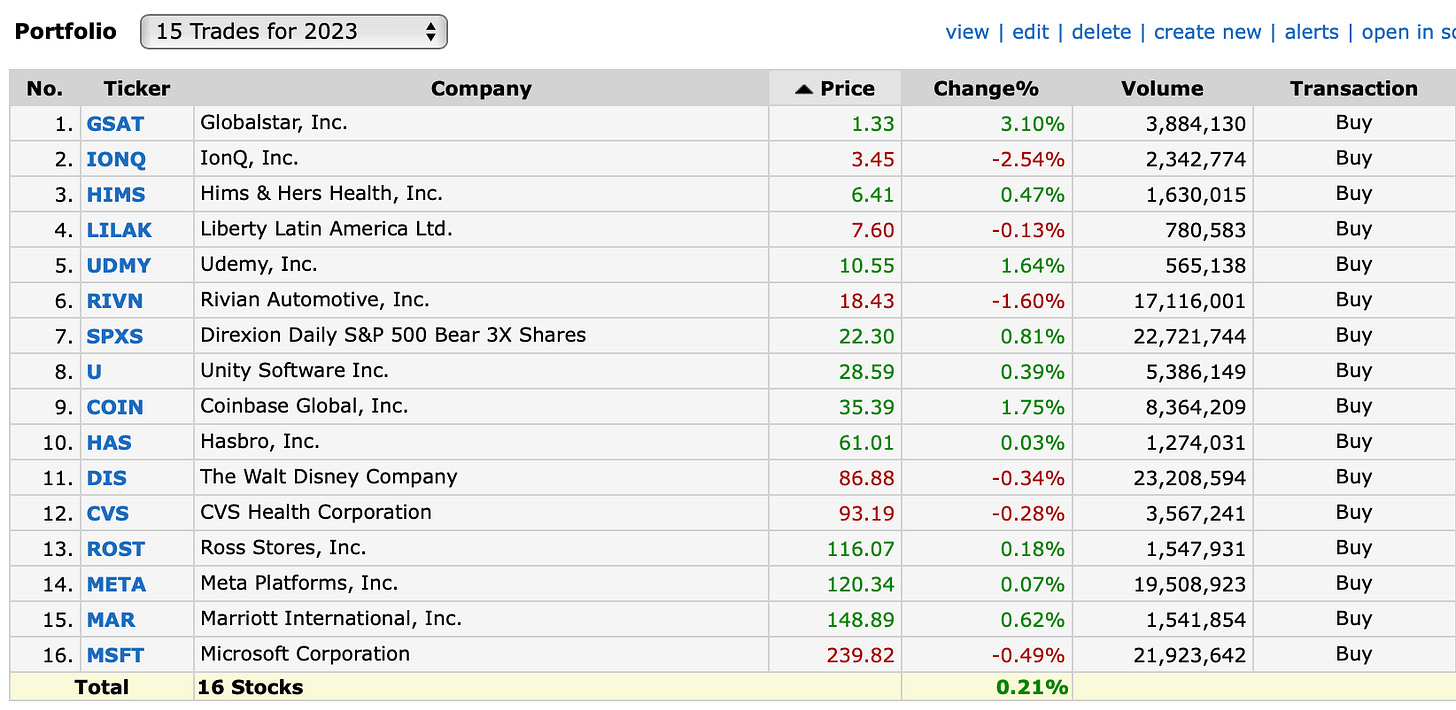

Here is the full portfolio of names I discussed today:

I hope you enjoyed reading. If this is your first time in our newsletter, welcome!

Feel free to email me at adit@whitepagefund.com with any suggestions. I will begin posting futures trade plans much more in 2023 but if you want anything more just let me know.

Thank you so much and have a happy new year,

Adit Dayal