Midweek Update (Post CPI and FOMC Ideas - 12/14/22)

By continuing to read, you agree to the disclaimer at www.aditdayal.wix.com/disclaimer.

CPI and FOMC is finally over (aka, the market has been able to make its decision on how it will react to inflation information).

I would also like to mention that none of my ideas are recommendations to buy or sell any security and you should 100% do your own due diligence on a stock, I’m just here to give ideas: you can read more here.

As expected, the Fed raised rates by 50bps, but the market reacted very negatively to the news:

Now, let’s look at my S&P 500 trade plans and my individual trade ideas:

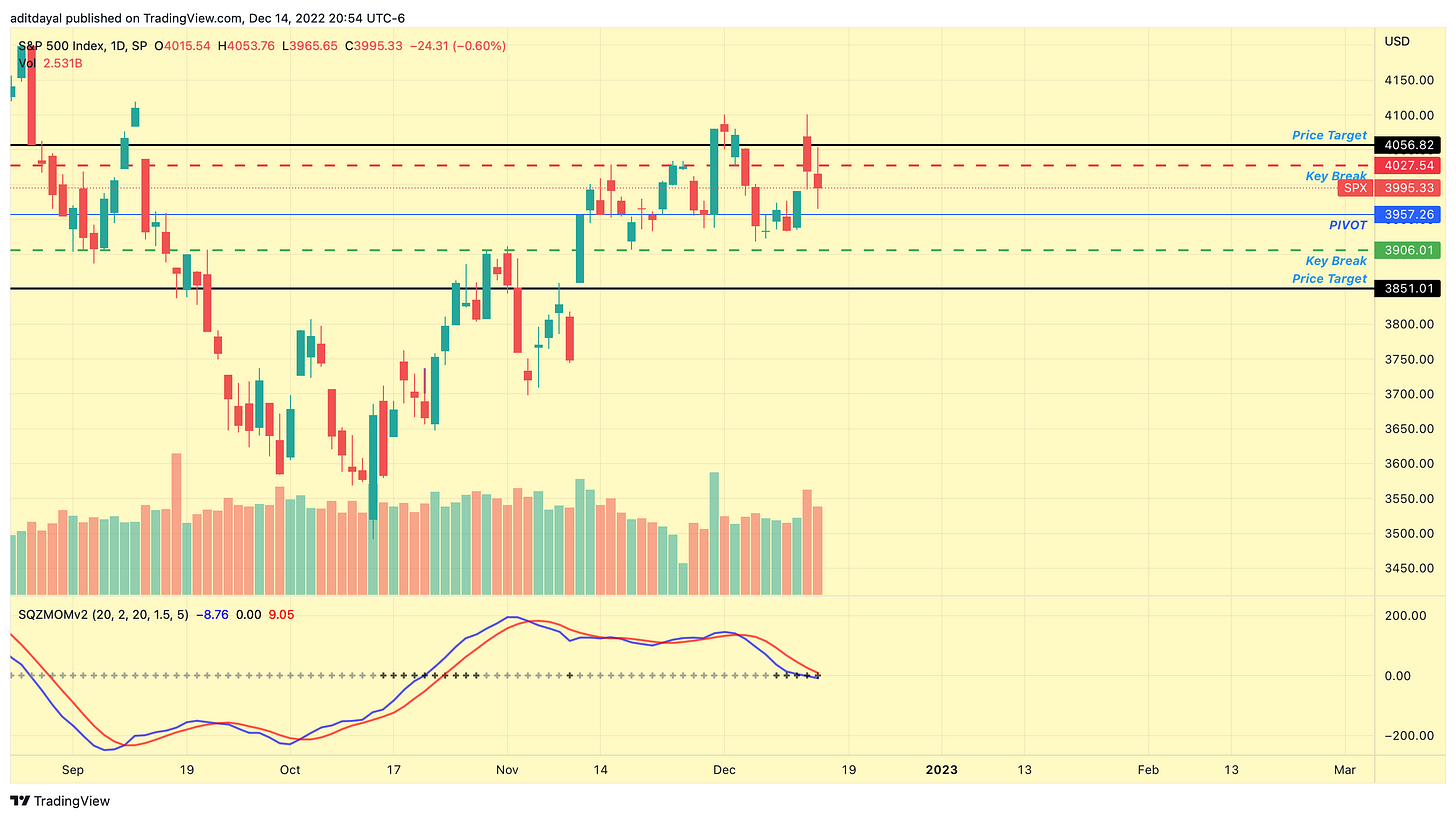

Here is my S&P 500 $SPX SPY 0.00%↑ trade plan:

Long over $4027 with a price target of $4056

Short under $4906 with a price target of $3851

PIVOT is $3957, meaning I am bullish overall as long as we hold that level and bearish under it.

Overall chart is bearish, so I will enter tomorrow with a slight bearish bias though I am ready to flip if necessary.

Here are some individual trade ideas:

Long GRAB 0.00%↑ . This is a smaller stocj taht's breaking out of this pennant here but has massive call flow behind with lots of actviity on the January calls which can really trigger a move.

2. Short COST 0.00%↑. This is a bear flag that can break down following the massive selling volume over the last few days. Nice put flow as well.

FOLD 0.00%↑ . This name has been basing for a long time. Nice inverted head and shoulders pattern with a huge gap to fill above if it breaks out. Puts work if we break under $10.91 and calls over $12.55.

4. Short AMD 0.00%↑ . This name is right on the verge of a huge breakdown from this pennant and if the market is weak it's a top watch. Bearish flow overall. If this is retesting its breakout level then I would go long over $72 or you can use that as the stop if you're bearish.

Hope this midweek watchlist helps, thanks for your support as always!

-Adit Dayal