Maybe The World Isn't Over? (8/8/24)

By continuing to read, you agree to the disclaimer at www.aditdayal.wix.com/disclaimer.

To be completely honest, every time you read the news it kinda feels like the world is about to end. It’s been a long time since the US has seen a Democratic frontrunner drop out of the race (last time, and only other time, was Lyndon B. Johnson in 1968) and then a former president gets shot before the election.

On top of all of that, in the markets you have inverted yield curves with no recession, you have markets moving hundreds of points in a day, and war looming in certain areas.

Well, it’s important to know that it really doesn’t matter when we’re trading markets. One of the fundamental tenants that I trade with is that the news comes after the price, not before. And the news that will move markets is already priced out, likely by a computer.

The most important thing to do is to block out the noise and focus on what the setups are telling you and then factor in what you feel could move the markets in the future.

Coinbase is in a traditionally bearish pattern after what has been a weak week, but I think there is room for a reversal in crypto, but it won’t come soon. In my opinion, we will see a little bit of chop, but the overall catalyst space looks good for the industry.

Both Trump and Harris are hoping to form a good relationship with he crypto space, with the Trump family promoting some sort of crypto project (??) and the “Crypto for Harris“ group hosting a town hall with Mark Cuban next week:

The “carry trade” has been the talk of the town recently, but what is a “carry trade“? A carry trade is when you use one currency to achieve superior investment returns via. a different one. People borrowed the cheap Yen, and invested it in the US, but when the Bank of Japan unexpectedly increased rates, the Yen surged against the dollar. This unwound the carry trade and led to a quick slide in both the US and Japanese markets. JP Morgan believes this trade is only halfway unwound.

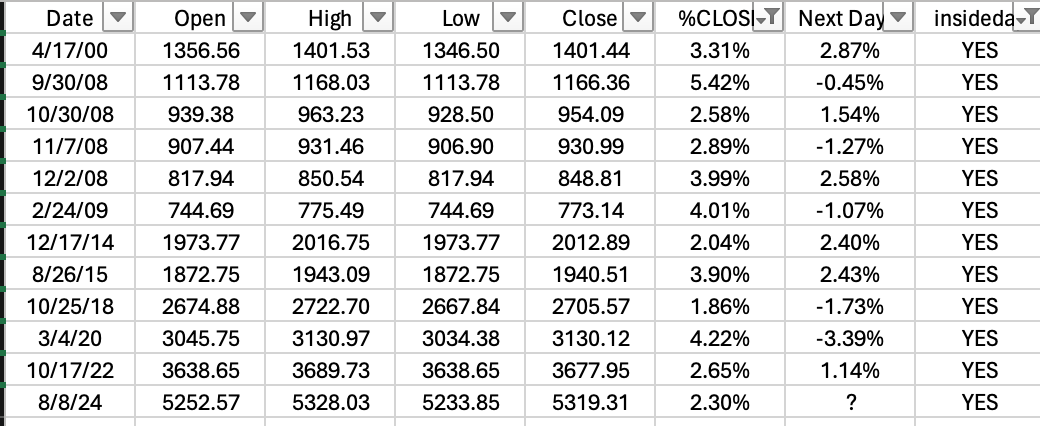

I am expecting tomorrow to be volatile on a technical and historical basis:

(Chart from Doublewide Capital)

The overall commodity index is hitting a point of support here on the longer timeframe weekly chart, so I’d start looking for certain commodities to spike:

Natural gas is breaking out here as Ukraine forces are entering an area of Russia with a key station:

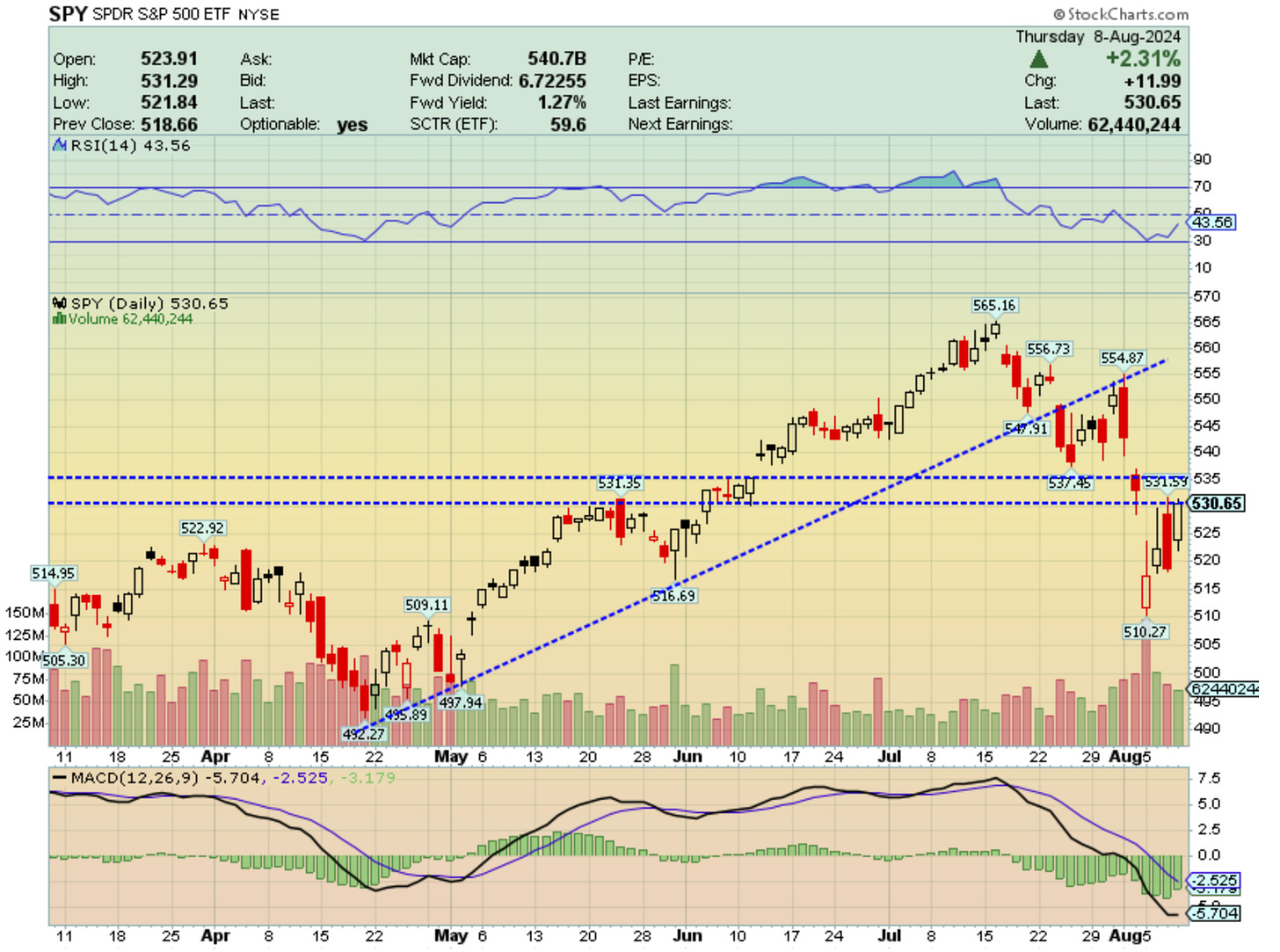

Over $531 the S&P ETF (SPY) has room to $535.

I hope you enjoyed this quick article and thank you for reading,

-Adit Dayal