Long TopGolf Callaway (NYSE: MDOG) - Take the Shot!

By continuing to read, you agree to the disclaimer at www.whitepagefund.com/disclaimer.

Investment Thesis

Topgolf Callaway Brands (NYSE: MODG) is extremely undervalued by Wall Street as they overlook the strong Topgolf business which employs strong unit economics and remains resilient compared to competitors due to its strong EBITDA margins. The brand will also benefit from the large spike in golfing interest globally and the expansion of off course golfing.

Business Overview

Topgolf Callaway is a company all things golf. They operate through three distinct segments: Topgolf, Golf Equipment, and Active Lifestyle. This means they sell entertainment through their venues, equipment like clubs and balls through their equipment segment, and clothes through their lifestyle. Any athlete who has played golf before has heard of the Callaway brand and understands the unique value their equipment side has (ranked 3rd overall by Bleacher Report - sports reporting brand from Warner Bros), and with the spiking popularity of golf, I expect this business to grow. But that is not what I believe the striking factor of this stock is that the market is overlooking. Callaway’s 2021 acquisition and merger with Topgolf is highly attractive as an individual business that can scale the brand to a completely new audience leading to a strong potential for EBITDA growth.

Market Overview

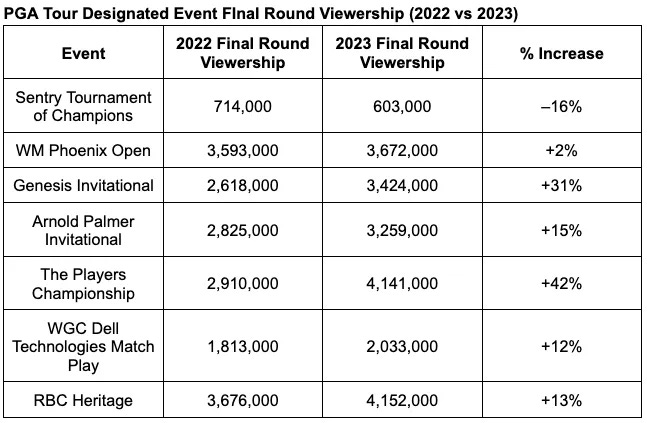

Explosion in popularity in golf as a sport is undeniable. The Players Championship had 42% growth in viewership compared to 2022.

In fact, there is a significant shift in the amount of golf players participating off course.

The increase in on-course players obviously benefit the Callaway brand, but the rise in off-course golfing is something that Topgolf is happy about as well (since they’re an off course solution) and benefits from unlike other competitors who do not have this crown jewel of a business.

The TAM (Total Addressable Market) for Topgolf is so much higher than companies when we look at it as an entertainment company for families (similar, in a way, to Disneyworld) but also one that takes advantage of the ever growing golf market.

How does each venue increase value?

The unit economics of each golf venue are also very strong. Management reports that revenue from small to medium venues are $13-18M/year while large venues generate $20-28M/year. Expected payback period for building these is only 2.5 years and then they are looking at 18-22% returns on gross investment after. That is not the only good part though: their calculations exclude their flagship large venues which typically exceed the unit economic projections and generate $40M/year.

MODG as a whole (which manages Topgolf, the Callaway brand, Odyssey, TravisMathew, and more) has a market cap of $2.35B. Callaway had begun investment in the Topgolf business in 2006, but finally acquired it at a valuation that puts it over $3B.

The worry here is that Callaway paid for a COVID induced fad, and while I do think valuations in 2021 were overpriced, I believe the acquisition of Topgolf was still strategic and the “fad worry“ has been priced out during this selloff. In fact, any company that now accounts for 39% of your total revenue is one you want to hold on to and one I would deem “strategic“. Callaway’s $3B acquisition now gives them ~$325M of EBITDA/year. MODG is pioneering the expansion of golf away from the course and into different areas of the game, including apparel and lifestyle, on course equipment, and off course experiences for the growing “non traditional“ golf player.

In fact, the company mentioned a target of $800 million in EBITDA by fiscal year 2025. They also completed a debt refinancing this March which helps the company in a few ways: there’s $300m in excess liquidity for the company to use, and they claimed they’ve reduced the cost of their debt which is great in a high interest rate environment.

Management

Management here has three important targets they want to hit (pun intended):

Re-invest their capital back into TopGolf and TravisMathew

Manage Leverage

Return capital to shareholders through buyback

I believe points 2 and 3 are interconnected, representing the idea that as the company deleverages themselves it would provide them ample opportunity to buyback shares.

The CFO says they’re tracking ahead of their goal of achieving a net debt leverage ratio of below 3.0x by fiscal year 2025 which helps the company a lot (explained more in Risks)

Management also continues to promise the Topgolf brand will be free cash flow positive by 2023 and they are promising to provide value to shareholders.

Appealing to Everyone

The brand has striking popularity with non-golfers as a social place which is a connection every other golf brand cannot compare with. The median age of any given golfer on a regular course is 54 years old, yet 54% (yes, interesting coincidence) of Topgolf guests are millennials. This connection leverage lets the company expand to any audience they really want to and helps us view this company as not only a “golf-centric” audience business, but one that is more like a movie theatre, a business that can appeal to everybody. If we can view this business as one that appeals to everyone as an entertainment company where families, avid golf players, millennials and elderly alike can go, we can understand the scale this can grow at is much higher than Wall Street (which sees this as a golf company) is valuing it at.

It’s Hard to Replicate Topgolf

I believe replicating Topgolf is of extreme difficulty leading the brand to have a monopoly of sorts. Part of the reason of the recent selloff in share price can be attributed to the openings of Tiger Woods’ new clubs “Popstroke”, but those are mini-putt venues that are not real competitors and therefore don’t pose a real threat to what Topgolf provides. Second, Topgolf’s closest publicly traded competitor is Drive-Shack which trades OTC as DSHK for ~25K shares/day at $0.25 and therefore is not the best stock to value this with. The other golf name on the market, GOLF, is the main competitor to the Callaway brand and manufactures the Titelist series.

GOLF has a market cap of 3.5B doing 349M in EBITDA while MODG has a 2.5B market cap doing 464M in EBITDA. Obviously Capex is higher for MODG as they have entire entertainment business, but if the Callaway brand scales to Titelist levels, it provides huge opportunity.

They already sponsoring some huge players with the brand, including Jon Rahm who made the switch to Callaway. Moreover, they’re adding the Top Golf branding to these players as well and provides for a two-in-one marketing move.

One take is that both MODG and GOLF will return to their mean value and converge again and a pairs trade can be in place. I do think the market is undervaluing how much more room for expansion MODG has in terms of being able to expand both their equipment and entertainment businesses.

In regards to the extreme difficulty for market entry, much of the venues (over 70) were built during a good time period for real estate development with low cost of the large land it requires in tangent with low interest rates to finance it with which is why I believe new competitors, like BigShots can have a hard time with expansion.

Technical Analysis & Valuation

Although much of this valuation is fundamental, I personally will never look at a trade without checking the chart first. Price relays information and the markets reveal a story. MODG’s Fibonacci retracement is at a key level here from the 2020 swing low to the local peak in early 2021, in which each retracement has been obeyed :

23.6% in late ‘21

38.2% in early ‘22, late ‘22, and early ‘23

50% in in early ‘22

61.8% in late ‘22 and early ‘23

Tapped the 78.6% here in Q4 with large buying support at $9 from early 2020 after the COVID overreaction.

In regards to seasonality, October tends to be seasonally weak, and the first half of the year proves to be better as there’s a spike in sales then. Here’s where MODG’s acquisition of Jack Wolfskin comes into play as they focus on outerwear. The diversification of MODG into different brands can help boost sales during times where competitors are unable to.

MODG has outperformed the S&P 500 in January 70% of the last 20 years and I expect that trend to be followed with a strong first quarter as well.

The company is trading below one standard deviation of the average of its blended P/E and while some investors may assume this as negative market sentiment I see it as an opportunity to purchase a market overlooked stock.

I believe a fair P/E valuation for MODG is 30 (~avg for the stock) and therefore the stock price after P/E change ≈ (1.4286) * $13 should be around $18.57.

Risks

If interest rates stay higher for longer and we end up in a recessionary period where economic conditions do not get better, their construction model can prove to be costly for the business.

A third-party real estate firm will finance 75% of the construction and then lease the land back to MODG, the issue is they collect the interest on the loan for the construction. Although break-even period for each location is only 2.5 years, these next 2.5 years are likely to be deadly for real estate and may hinder growth of new locations. That being said, an EBITDAR margin of 35% on each venue provides extremely strong return on the investments they already have. In Q1 2023, they had $1.2 billion in venue financing liabilities as they tried to continue expansion. The risk here is the rise in interest rates can lower the return on each course, and it likely will, but the large margin gives us room to work with.

It’s key for management to optimize their operational efficiency here and focus only on expanding smaller commitment venue in my opinion. I mentioned how site selection is identified by looking at the population of surrounding areas and then giving a “small“, “medium“, or “large“ venue to each, and a lower cost commitment in smaller areas may be what the company needs to focus on in order to reduce financial burden. The good news to me is that management has realized this and I can get the hint that they’re focusing on existing businesses right now based on this from their international franchising page:

The higher interest rates on the lease liabilities and the term loans indicate that higher interest rates can hit the company and I don’t like that their convertible notes due for $258M and expire in 2026 can dilute the company for what’s worth up to 10% of its current market cap.

The good news is one of the main focuses of management is to reduce their leverage and focus on existing clubs instead of expansion.

I think the opportunity here lies in the growth of existing venues and buying when there is fear in the markets over how consumer discretionary and interest heavy plays will pan out, but I think MODG has the potential to maneuver carefully around these risks and they have a cushion to land on with each venue returning profitably.

Conclusion

Topgold Callaway Brands (MODG) has significant room for profitability and dominance in the growing golf space, with strong unit economics and margins on

each venue of the Topgolf brand. Moreover, the Callaway brand is undervalued compared to competitors like GOLF. The merger between both of these two brands is strategic and management expects the Topgolf business (which now accounts for ~40% of the brand’s revenue) to be cash flow positive by next year.

Current price as of writing: $12.60

PT: $18

SL: 7

Investment Horizon: 6 months-2 years

UPCOMING RISK: earnings on November 8th

Thank you all for reading, please leave a comment with your thoughts or share this if you enjoyed it.

-Adit Dayal