Is Bed Bath and Beyond a buy at $6?

Enter retail investor Ryan Cohen and Freeman Capital... but is it a buy?

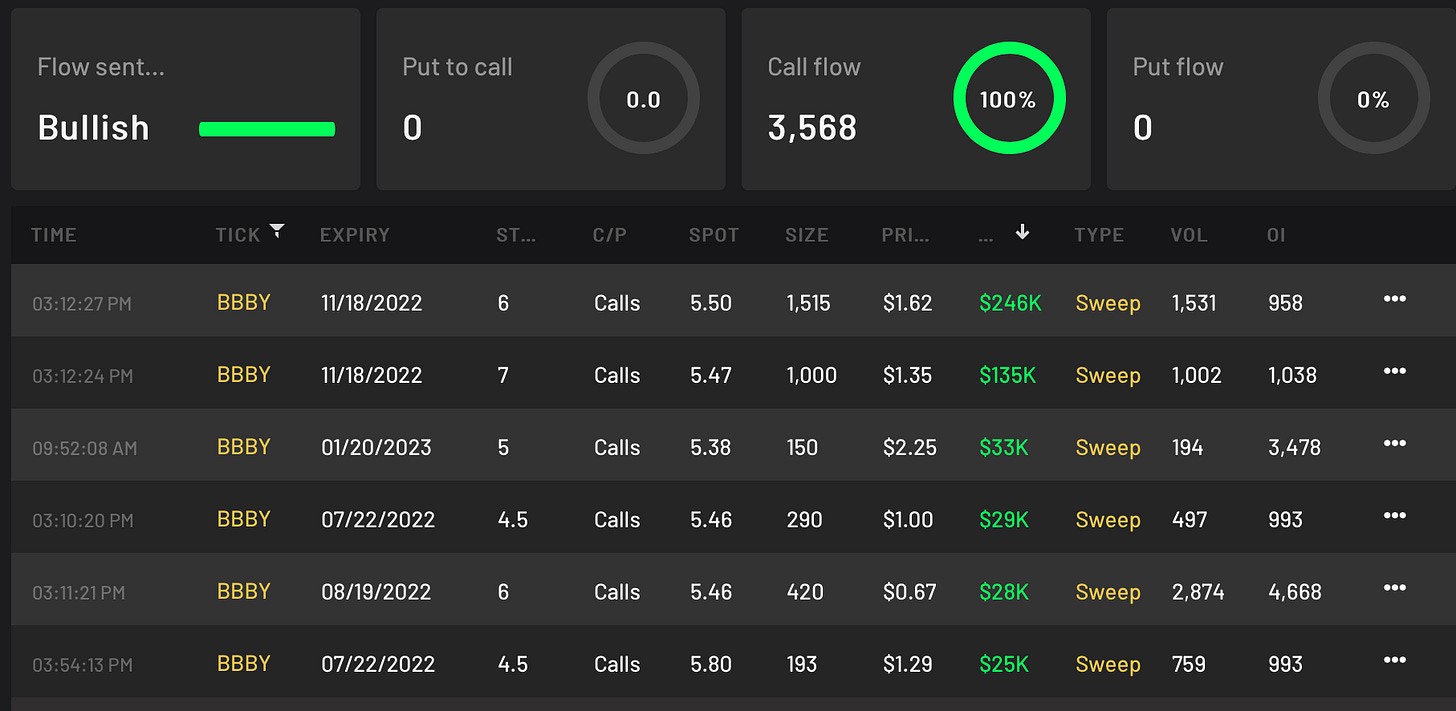

BBBY 0.00%↑ shares traded higher today on news that Freeman Capital just bought out 6% of the company. The stock is currently $5.69 here and I believe can see higher.

The Buy Buy Baby business is valued at $1 billion. It’s possible that Cohen tries to spin this off and that would generate a lot of cash for BBBY 0.00%↑ . Another thing to note is the impact that Ryan Cohen has. He was the one that took the large position in GameStop, so he is fuel to this fire.

On a technical level, the chart is also about to break out and has a gap to fill to the upside, but what makes this trade special is the short interest factor.

According to S3 data partners, one of the most accurate in the industry, Bed Bath and Beyond has over 40% short interest which means that is Cohen or the company itself takes action to create a drastic increase in stock price (aka spinning off the BuyBuyBaby business or any other plan) it will trigger a short squeeze because of the large amount of shorts that will be trapped.

Under $5 this play becomes invalid to me but with the potential to squeeze to 10, we are looking at an almost 1 to 7 risk reward ratio here. Lots of speculation and risk as we are in a bear market, but this can prove to be a successful trade.