"F*** Your Puts!" - Jerome Powell, Probably

By continuing to read, you agree to the disclaimer at www.aditdayal.wix.com/disclaimer.

Ok, so, it’s been a minute. The last article I posted was an analysis of TopGolf stock (which is up ~20% btw) and the SPY was trading at~$430/sh. Today the SPY closed at $470: an insane move for an index fund in just a little over a month.

So what’s next? Is this a massive short squeeze with Apple touching a new all time high or is this the last leg up for the Magnificent 7 (META, AAPL, NVDA, MSFT, AMZN, GOOG, TSLA) before a whole new wave comes into play?

The Federal Reserve maintained the 5.25%-5.5% interest rate target, but that was expected and not why the market has been so strong. The updated Fed dot plot now calls for three rate cuts in 2024 (which is coming by fast), four in 2025, and three in 2026.

Hence, “F*** your puts“ - Powell in another universe.

Billionaire trader Bill Ackman thinks interest rates will get cut in Q1 of next year much unlike many other traders. “What’s happening is the real rate of interest, which is what impacts the economy, keeps increasing as inflation declines” according to Ackman and he believes if there’s no cut in Q1 then we may head into a hard landing.

Powell himself did say that the US does not need a recession for the Fed to begin cutting rates. The questions is: is there really evidence of a weakening economy?

Currently the ideal goal of the Fed is to keep unemployment low, inflation low, the economy growing, and as a byproduct of all of that, the stock market at new all time highs.

The end of low interest rates prompted me to learn a new term: TINA aka “There is No Alternative“ to equities, and that era is over with bonds returning ~5% squeezing out the equity risk premium.

One might think risk is off, but that’s not the case.

ARKK which is Cathie Wood’s growth fund is up 68% YTD and Bitcoin is up 154% YTD, signaling to investors that risk is still on.

It feels like we’re returning to a more normalized, full world in terms of finding returns in places other than equities. Whether that means debt, commodities like Gold and Silver, or even crypto.

If you missed the Magnificent 7 Rally, you may be wondering if there’s still fuel to go, with the rally leading those stocks to account for 1/4 of the S&P 500 index. The CEO of Strategy Asset Managers stated that he believes the rally will pause, but there is still room for growth next year as we feel the effects of AI play into these companies. Piper Sandler showed that spending on AI doubled from 31% last year to 62% this year leaving the idea that the Magnificent 7 may become the Magnificent 7 + a few names that can prove themselves to be innovators in this new age.

Goldman Sachs writes that the traditional 60/40 portfolio should offer better risk-reward in 2024. The reasoning behind this is that while equities still remain expensive compared to a standard average (since 1871), bonds are just now returning to a long term average. They also believe commodities are useful as a diversifier for two reasons: first, the increased volatility from the geopolitical risks of the Middle East, and second, the “demand for electrification metals“ like copper.

Here’s what they say the secret to making money is in 2024: look for alpha outside of beta. Sounds like a whole bunch of useless Wall Street jargon, but I think the advice is valuable. Less correlation with traditional assets can be valuable to generating alpha in 2024: commodities, but specifically private investments which have low correlation to public markets are where they expect people to generate alpha in 2024.

I just discovered this last week you can invest in private companies like SpaceX through Cathie Wood’s volatile private fund. I would like to mention the extreme volatility of that investment vehicle and the absurd 2.9% management fee. Lol.

That being said, private investments are hard to come by and illiquid most of the time: so what’s the outlook on public equities?

The GS S&P 500 target is at 5100 with an EPS estimate growth of 5%. The IPO market should heat up and lower interest rates should help high borrow companies. Speaking of IPO’s, there are some big names rumored to take it public next year: Sports brand Fanatics, Chinese fast fashion giant Shein filing at a $90b valuation, Reddit, Skims by Kim Kardashian, and buzz around Databricks and SpaceX (both already available through Cathie Wood’s public/private fund vehicle).

Barron’s has also released their picks for their top 10 stocks of 2024, including Alibaba, Barrick Gold, BioNTech, Berkshire Hathaway, and a few more.

2023 was probably the worst year for home-buyers in the US, but Redfin finally expects that to ease next year. Want to get grip on exactly how hard it was? The median US salary was $78K and the average cost of a house was $408K on Redfin and according to their estimates that means north on 40% of monthly income goes to housing payments.

I’m going to list the 7 predictions they made, but if you want more details on each please go to the source I linked above:

Home prices will fall 1%

New listings will tick up

Home sales will increase and end the year up 5%

Mortgage rates will steadily decline–but remain above 6%

Change will come to the real estate industry (homebuyers to work directly with listing agents)

Renting will lose its stigma

Biden has a housing problem, which could hurt his re-election bid

Interesting predictions and I like the idea that prices can fall but home sales can increase. The median rent has also fallen by 2.1% which is the largest drop since February 2020 with renters finally able to catch a break. Apartment construction has risen 7% to a boom in supply for apartment housing.

Note from Adit in the future: there’s a bunch of percentages in this next paragraph.

What about the presidency? 2024 is going to be huge for the United States because we may have a new President. 49% of investors are concerned about the election affecting them next year vs. 35% for inflation and 29% for recession. Returns on election years average 9.9% while the returns on non-election years average at 12.5%. This plays into my prediction for the overall market returns next year: green to flat. Next year’s presidential run sucks, let’s be honest. 56% of of Democrats aren’t satisfied with Joe Biden as the candidate and 58% of Republicans aren’t satisfied with Trump as the GOP pick.

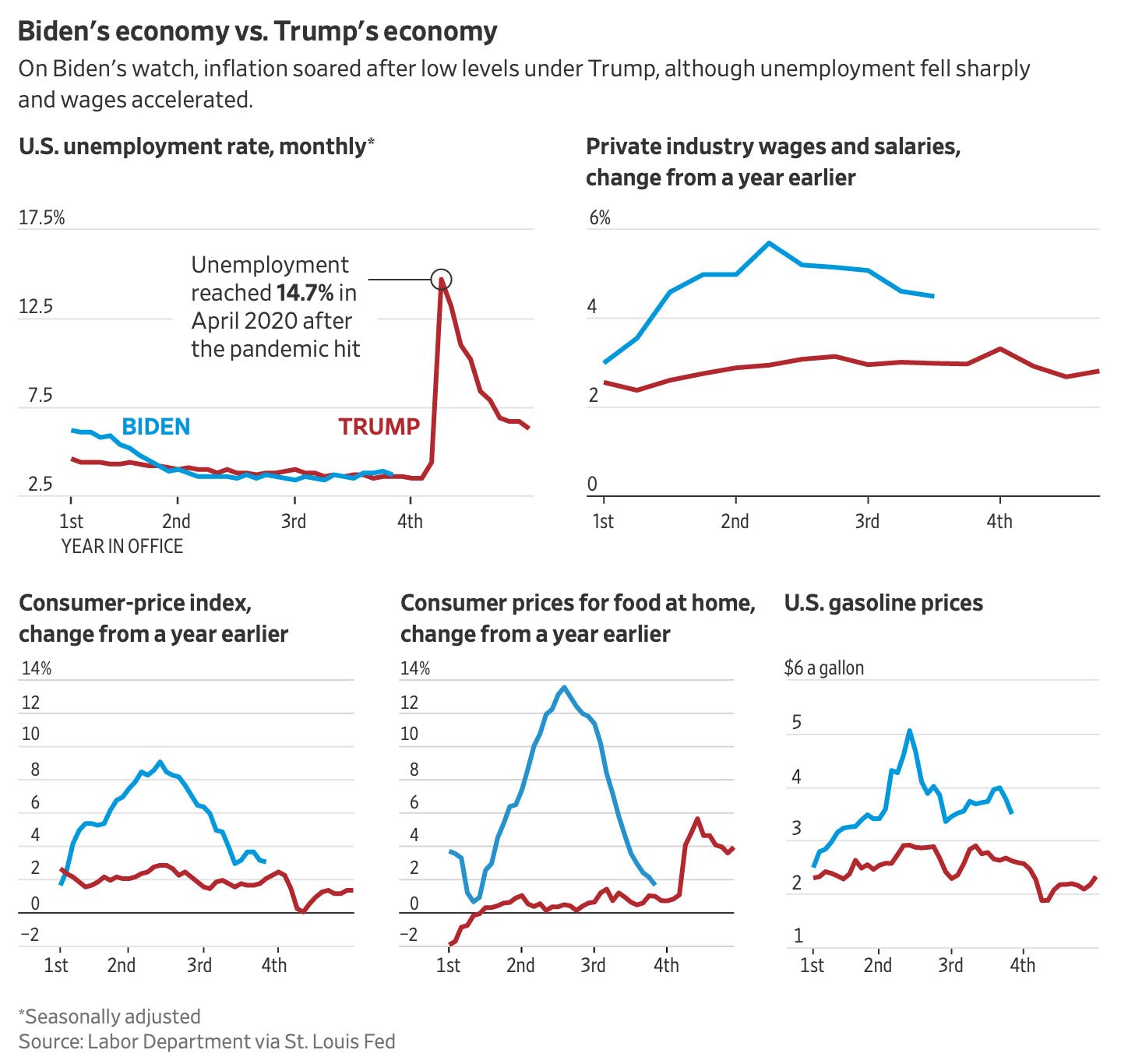

According to a poll I found by NPR from March, the economy is the main thing that’s driving votes in the US and I expect that to be the case next year as well. Voters vote with their wallets and this time is no different and, in fact, the most important. Post-COVID, we were faced with rampant inflation and if consumers are feeling the effects of the monetary tightening we may see a change in leadership. This is interesting because a little bit of education can change how we vote: the president is barred from influencing or telling the Fed how they should work with interest rates. On the flip side, the President can nominate the Chair of the Federal Reserve. If Trump gets voted in, he has publicly stated that he will not reappoint Powell to lead the Federal Reserve and that’s the unexpected catalyst that may shake up the market.

Thanks for reading today’s article and Happy Holidays,

-Adit Dayal