Educational Article - SPACS

By continuing to read, you agree to the disclaimer at www.aditdayal.wix.com/disclaimer.

Good evening traders! We had some great plays today, this morning I shares SINT 0.00%↑ as a short squeeze trade :

If you can’t read that article and want to receive my newsletters, make sure to subscribe:

I was doing my research for the night and saw RNER 0.00%↑ was trading volatile, and that TPBA 0.00%↑ has a ticker change to $LRVO tomorrow.

Over the last few days we’ve seen a lot of action in SPAC names. You might remember CCIV 0.00%↑ which was a SPAC that became what we know as LCID 0.00%↑ .

In fact, these SPACs were very popular in the 2020/2021 stock market run, names like DKNG 0.00%↑ SOFI 0.00%↑ NKLA 0.00%↑ QS 0.00%↑ are all spacs. But what is a “SPAC”?

Some of my best trades have been SPACS and the reason for that is that they can become very low float stocks for a short amount of time.

Let’s get into it.

Special Purpose Acquisition Companies, or SPACs, have become popular as a means for companies to go public without going through the traditional IPO process. This is because the SPAC process is giving these companies faster access to capital.

One aspect of SPACs that has garnered attention is the potential for them to become low float stocks. A low float stock is one with a relatively small number of shares available for public trading, often making them more volatile and subject to price swings.

SPACs start as a "blank check" company with no operations or assets. They raise capital from investors through an IPO and then use those funds to acquire an existing company, effectively taking that company public. Once a SPAC has completed its acquisition, the shares of the acquired company are converted into shares of the SPAC.

Take for example Virgin Galactic (the company that’s sending people to space):

In 2019, Virgin Galactic merged with Social Capital Hedosophia, a SPAC founded by Chamath Palihapitiya, who is now an infamous venture capitalist and unofficial pump and dumper. After the merger was completed, Virgin Galactic began trading on the markets under the ticker SPCE 0.00%↑ in 2019.

The SPAC becomes the public company, and the private company becomes a subsidiary. The merger process allows the private company to go public without going through the traditional IPO process.

However, not all investors who bought shares in the SPAC prior to the acquisition will necessarily want to hold onto those shares after the acquisition. This is where the potential for low float stocks comes into play.

How SPACs become low float stocks (which are the best, imo, for daytraders)

Redemptions:

When a SPAC acquires a target company, it typically needs to hold a shareholder vote to approve the transaction. Prior to the vote, investors in the SPAC have the option to redeem their shares for a pro rata portion of the funds held in the SPAC's trust account. This redemption process is typically limited to a certain percentage of the total shares outstanding, often around 20%. If more than this percentage of shareholders opt for redemption, the acquisition may not go through.

Redemption can be a way for investors to exit their investment in the SPAC if they don't want to hold onto shares of the acquired company. However, it also reduces the number of shares available for public trading, potentially making the stock more volatile BY REDUCING THE FLOAT!

Case study time: GETY 0.00%↑

Redemptions were 82,291,689 versus CCNB’s public stockholders of 82,800,000 = 508,311 float for GETY 0.00%↑ after DeSPAC. Essentially nearly ALL of the float was redeemed and therefore locked up to the public, leaving only 500K to the public.

The lower the float, the easier it is for the share price to move, and therefore retail investors jump in on it.

Here is the SEC form where you could find that information:

Now let me show you where things get really interesting and how you can identify huge asymmetric risk/reward opportunities:

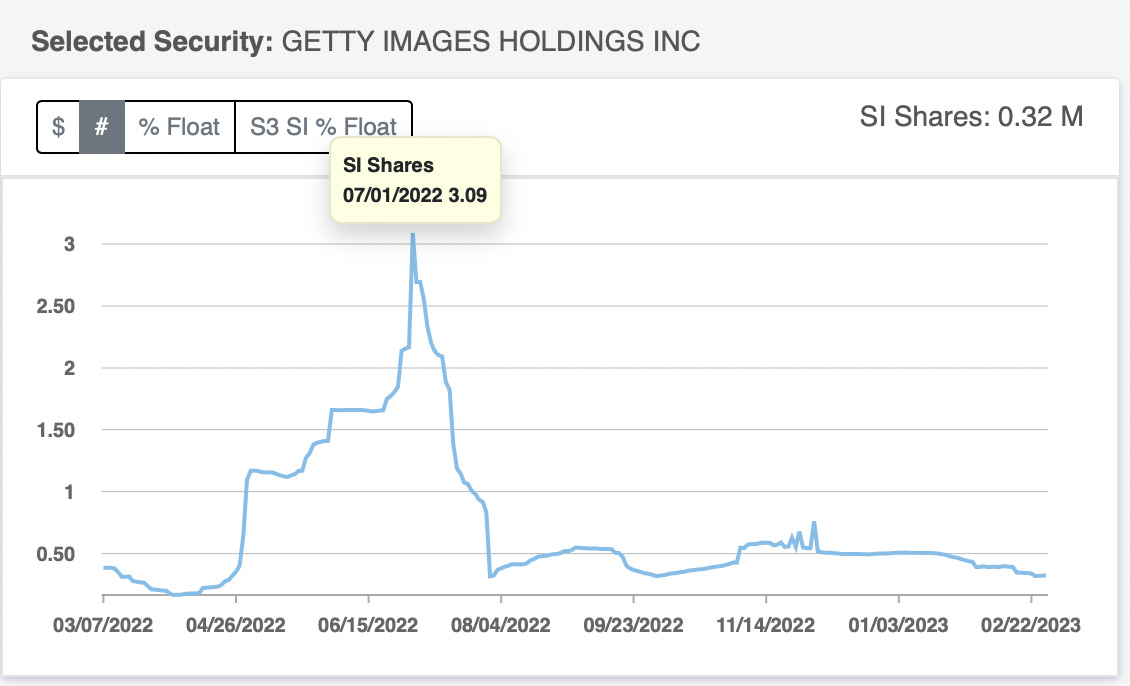

SHORT INTEREST. At the time of $GETY’s redemptions, 3M shares were being sold short with only 500K on the market. That leaves 6X of the float shorted which is massive, and when retail drives up the price of the stock because it’s a low float, shorts have to cover.

Low float + high short interest = explosion.

GETY 0.00%↑ went from $10 -> $33 and my best trade, SST 0.00%↑ went from $15 to $37 overnight giving us a 5000% return on options.

Extensions:

Another factor that can contribute to a SPAC becoming a low float stock is if the SPAC is granted an extension to complete its acquisition. SPACs typically have a deadline of two years to complete an acquisition, but this can be extended if a majority of shareholders vote in favor of it. If a SPAC is granted an extension, it may result in some investors selling their shares, further reducing the number of shares available for public trading.

Example: today, Donald Trump’s SPAC for Truth Social, DWAC 0.00%↑, was granted an extention to June 8th.

Agreements:

Finally, it's worth noting that some SPACs may enter into agreements with certain investors or institutions prior to their acquisition. These agreements may allow the investors to purchase shares in the SPAC at a discount or receive additional shares if certain conditions are met. While these agreements can provide a source of funding for the SPAC, they can also further reduce the number of shares available for public trading aka increasing the float.

SEC Filings:

You need to keep up to date with certain filings that these SPAC’s will release. Here I will cover a few of the important ones so you don’t get caught in a drop, because just as fast as these companies go up, they go down as well. Many times, you’re not trading the company but rather the technical opportunity within the stock itself for no longer than a day or two.

S-1: This document is filed by a SPAC when it goes public through an initial public IPO. It outlines details about the SPAC's business and structure, and includes information about the number of shares being sold to the public. Once the S-1 is declared effective by the SEC, the SPAC's shares become available for trading, increasing the float.

S-4 : This document is filed when it announces a merger or acquisition target. It contains details about the target company and the terms of the transaction, including the number of shares that will be issued to the target company's shareholders. Once the S-4 is declared effective by the SEC, the SPAC's float may increase if the target company's shareholders choose to hold on to their shares, or it may decrease if they choose to sell their shares on the open market and that is why this is one of the most important ones to watch for.

8-K Report: This is not specific to SPAC’s but it’s very important because it covers filings within 4 days of when an event happens. An event can include: mergers, acquisitions, bankruptcy, noncompliance, changes to the companies trading securities, etc.

The GETY form above was an 8K.

An example from today was GSAT 0.00%↑ where if you caught they announced $252M loan from Apple for their satellite service.

You can read the full filing below:

GSAT 0.00%↑ went from $1.15 to $1.33 on this news.

Thank you for reading and I hope this article helped you learn something. It takes a bit of time to write these, so if you would consider supporting or sharing the Substack that would be great.

Have a great night and see you tomorrow,

-Adit Dayal.