China, Japan, and Nuclear Powered Bitcoin

By continuing to read, you agree to the disclaimer at www.aditdayal.wix.com/disclaimer.

Read to the bottom for a FULL GUIDE from JP Morgan on how to interpret economic data before the election.

Okay sooooo. China.

My guess is that someone in their policy office saw some data like this, thought “hey that’s not great“, and pressed the big shiny button that says stimulus a couple times too many, and then a couple times after that.

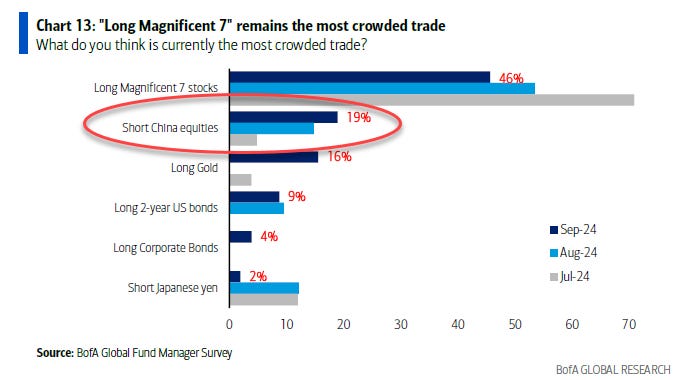

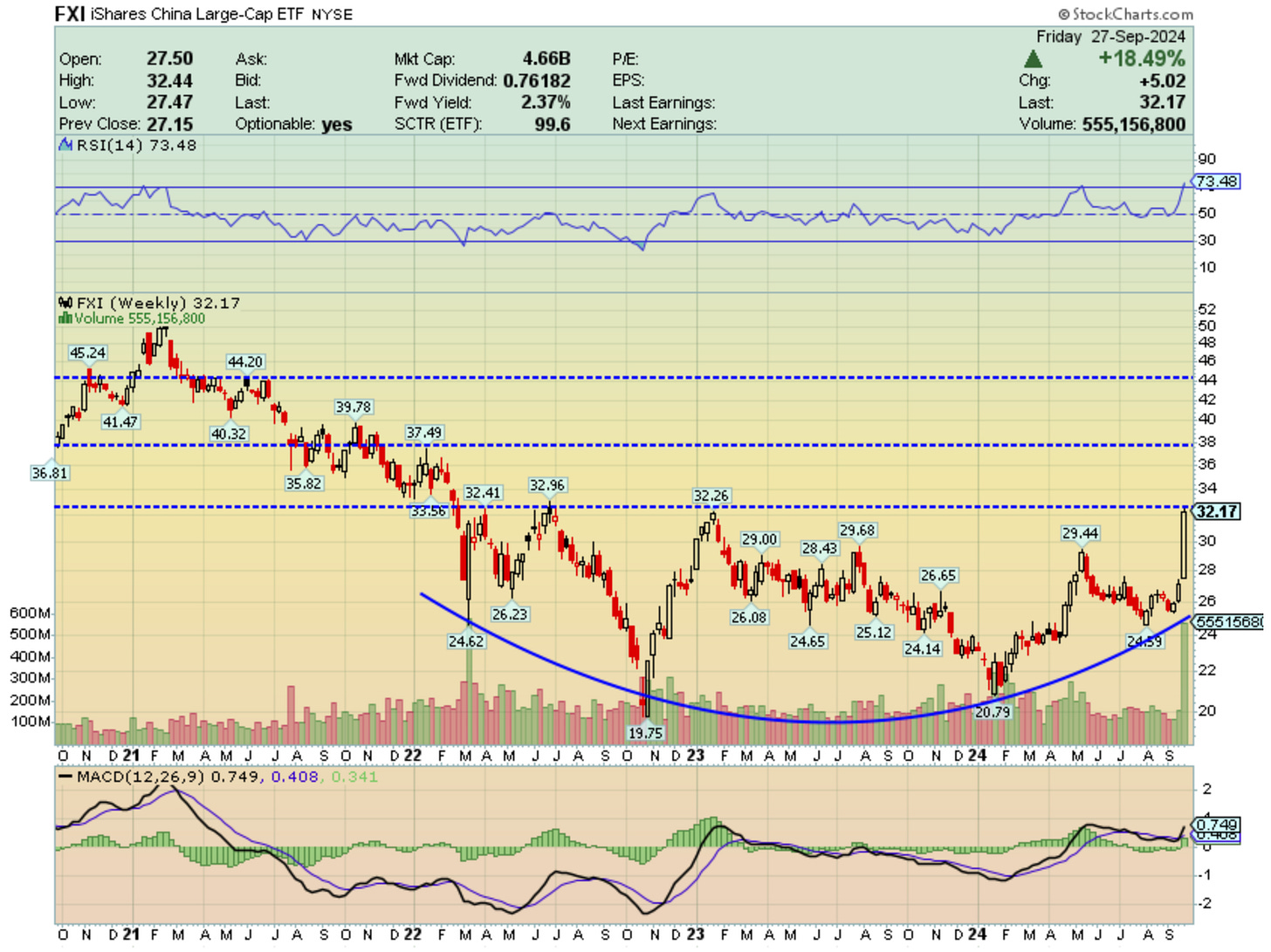

In effect, Chinese stocks have gone nuclear and I don’t think this rally is going to be short lived anyways. Bank of America published research a little bit ago saying that “Short China“ was the most crowded trade and there are a lot of shorts that need to get out here.

The FXI China Large Cap ETF weekly chart shows this trade has legs up to $38.

On the other part of Asia, Japanese equities look weak after Shigeru Ishiba was elected as Prime Minister. He’s been a big advocate for the BoJ to raise interest rates and for a higher corporate tax rate. This obviously sucks for companies, so watch for names like Toyota TM 0.00%↑ to drop tomorrow if they don’t already do it in the overnight session.

If you don’t know Stanley Druckenmiller, he’s a pretty famous hedge fund manager who Wall Street likes. He made some news last quarter when he bought WULF, which is a Bitcoin miner who uses nuclear as its power source. Pretty interesting stuff, huh.

Well I found what I believe to be a pretty interesting crypto trade, especially as interest rates come down and speculation in the sector increases.

Enter BITF.

RIOT (their largest shareholder) tried to acquire them ~10% below current levels, which management vehemently declined citing how undervalued of an offer that was.

Nuclear energy is making a comeback into the energy sector amid declining oil demand, and with a huge name like Druckenmiller buying into it, I imagine this theme can gain some traction. Constellation Energy just signed a massive nuclear deal with Microsoft for 20 years and sent their shares up over 20%.

They’re also hiring experts who have done this before as well as a settlement with RIOT to end their hostile takeover.

With a tight SL under $2, this can be a really interesting play if money starts to become more speculative again and move back into crypto.

What to watch:

Monday - Powell speaking, East Coast Strikes on the ports

Tuesday- SMCI stock split

Friday- Sept. Jobs report, unemployment rate expected to remain at 4.2%.

Here’s the roadmap to the election if you’re wondering how to interpret the data that’s coming out soon:

Thanks for reading and have a great week in the markets and elsewhere!

-Adit Dayal