Adit Returns When The Market Doesn't

By continuing to read, you agree to the disclaimer at www.aditdayal.wix.com/disclaimer

Happy August everyone! I’m returning to this newsletter after taking a short Summer break. Hope you all had a nice summer.

In this article, we cover some quick updates as well as making money on the Presidential election (as well as a position I currently hold).

Quick Updates

It seems like doomsday is something market experts are relating to a little more than comic book fans these days, with the last few days being really tough for bulls- though the last few months were pretty easy for them.

The weird part about dips like these is that your entire Twitter feed states that they’re buying opportunities, but if you were holding literally any amount of cash this year, weren’t you underperforming?

That’s the weird questions and why the hardest part of trading is position sizing.

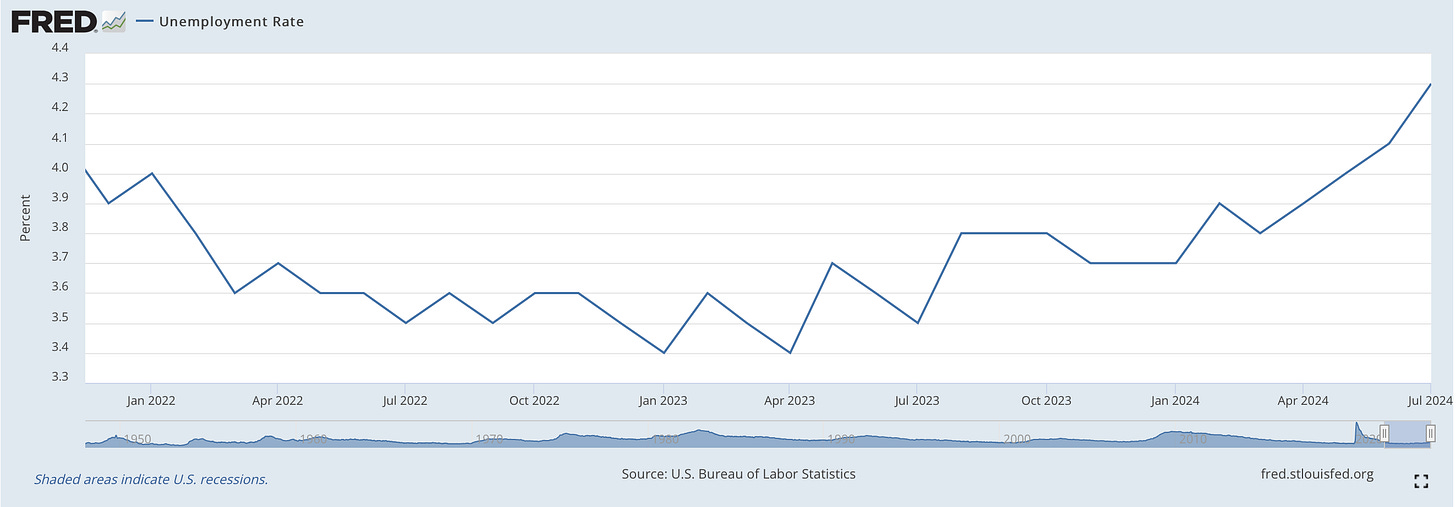

With unemployment hitting a 3 year high, traders are wondering if the Fed took their tightening plan a step too far.

Increased unemployment can mean lower corporate profits and that hit the market strong. The AI narrative is pretty over-done as well, with Elliott Management stating that it’s “overhyped” and in a bubble. That being said, Wedbush’s Dan Ives believes that Apple Intelligence’s launch justifies another $30-40/sh increase in valuation for the company updating his PT $285 after yesterday’s earnings.

Presidential Market Alpha

The prediction markets right now are a beautiful source of inefficiency and arbitrage. Polymarket, a crypto based prediction platform, recorded $1b in transactions as of July.

But how do these markets work?

Think of buying a “bet“ as buying a contract that will settle at either $1 (if you’re correct) or $0 I(if you’re wrong).

In this example below, almost $500M has been bet on the election winner. To trade Kamala coin, I can buy it for $0.44. If she’s elected, it settles at $1.

Therefore with 100 shares, I place $44 on the line, and it settles at $1, profiting 126% on this trade.

What I truly love about these markets are the information advantages and the discrepancies within different markets.

For example, Bovada has different odds than Polymarket on who the winner of the Democratic VP will be:

This was a smaller discrepancy, but when information begins flowing, these gaps widen, leading to arbitrage opportunities.

I currently hold a Polymarket position in Josh Shapiro at 70 cents.

Other than that, not many updates here on my end. When I see an interesting opportunity, I’ll always let you guys know.

Thanks for the continued support,

Adit Dayal